RMHI Humane Portfolio Model Tests and Results

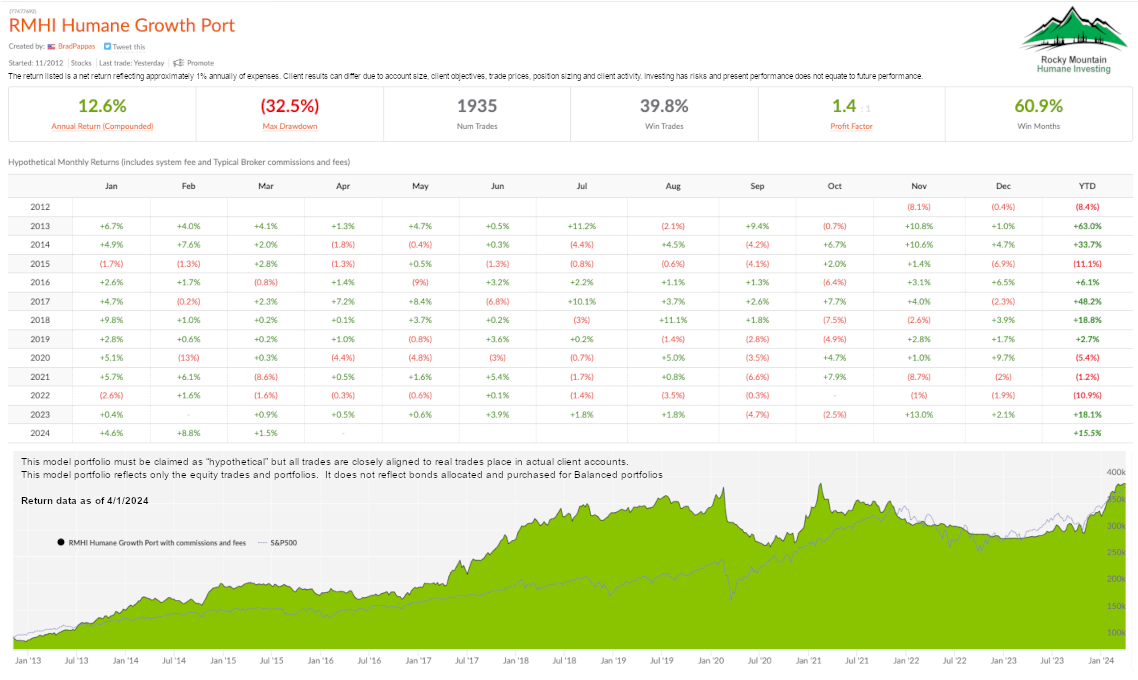

The RMHI Humane Growth Portfolio Model Test Results as of April 1, 2024.

Actual client Quality portfolios are based on the RMHI Human Growth Portfolio which is a model portfolio that hypothetically represents the performance of our client portfolios. RMHI also manages Balanced accounts which can have U.S. Treasury Bonds in addition to equities. Collective2 (C2) is an independent organization (from RMHI as well) that calculates and represents the trading made in our model account. We place trades in the C2 model portfolio usually but not exclusively made within the RMHI Humane Portfolio at Collective2.com within the same day as client trades. Benchmark comparison is the S&P 500. Profits (when there are profits), dividends and interest are reinvested. Model portfolios are a useful tool to gauge the effectiveness of our investment strategies but they do have limitations that prospective investors should be aware of:

The model is based on a maximum of 35 positions and at least $150,000 initial investment. Accounts below $150,000 would potentially have a reduced number of positions and that would affect performance and risk. Actual client results will likely be different for many reasons: Investor holdings can differ from the model portfolio on C2. Trades made in the C2 model portfolio are hypothetical trades but not actual trades. Buy and Sell trade prices will differ as well as differences in position sizing in client accounts which can affect performance. For new clients we chose the most attractive securities for their portfolio first. We do not replicate the entire RMHI Humane Growth Portfolio as posted on C2 unless specifically requested. The primary goal of the RMHI Humane Growth Portfolio is growth. The RMHI Humane Portfolio is not suitable for very conservative investors or those who are uncomfortable with short or intermediate term investment risk. Investing and trading is always risky. While we do our best via position sizing and stop losses to reduce risk. Risk is an ever present factor. Short term volatility of the RMHI Humane Portfolio can be greater than the S&P 500 index. While our strategy has been profitable in the past there is no assurance future performance will be similar or even profitable. An investor can safely assume the future economic and monetary environment or unforeseen events will differ from the previous years. Investors should understand that the majority of time the value of their account will be below its high- water mark. Draw-downs in account value are common and may exceed previous drawdowns.