The RMHI Quality Portfolio

Committed to providing a competitive tax efficient return while aligning investments with ethical values

Foundations of Quality Investing

RMHI invests in a concentrated portfolio of approximately 20 stocks for Growth and Balanced oriented investors. Balanced investors will hold the same stocks with added fixed income for income and stability. Appropriate Growth investors can be up to 100% invested.

For investment selection, RMHI focuses on companies that have demonstrated stable and consistent returns on capital and linear price performance relative to the S&P 500 index.

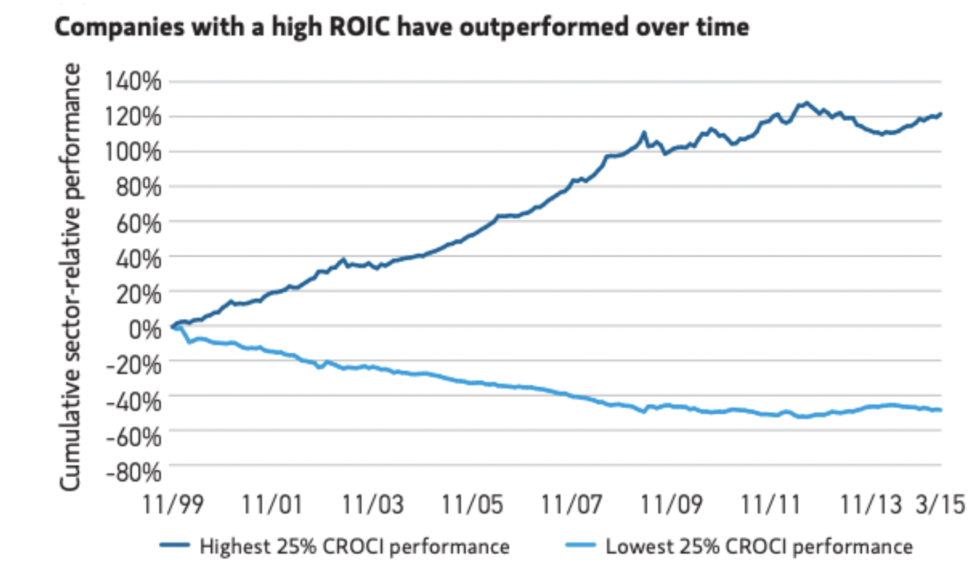

Shares of companies that meet our criteria show high rates of return on Invested Capital “ROIC” – usually above 20%. ROIC measures the percentage return of profitability a company earns using the capital invested by equity and debt providers. It measures efficiency regarding capital deployment and the return earned after deployment.

The initial research for this strategy can be traced to investors such as Warren Buffet. In 2016, Morgan Stanley published “The Equity Compounders”: The Value of Compounding in an Uncertain World” by Paulson and Derold.

These are considered high-quality companies with recurring consistent revenues with pricing power that is only modestly affected by economic cycles. These are dominant and frequently name-brand companies with a significant advantage over potential rivals.

The companies we prefer are those with “Moats.” They have a significant advantage over any potential competitors. Ideally, the companies we choose to invest in are monopolies or duopolies. Monopolies and duopolies are attractive since they have pricing power, allowing them to raise prices without concern for customer departures. Moats create barriers of entry for new competition, which protect profit margins and pricing power.

Source: The Equity “Compounders:” The Value of Compounding in an uncertain world. Morgan Stanley International Equity Team 2016 Paulson and Derold

Rocky Mountain Humane Investing.

For over 25 years, Rocky Mountain Humane Investing has been providing clients with cruelty-free, socially responsible investment management.