Two years ago I began to write conceptual articles based on “What do investors really want?”. At the time the vanilla stock-centric approach to investing was working fine and there was no way to distinguish our philosophy from any other traditional investment adviser. Bear markets in stocks are a fact of life and rather than being a cheerleader with the hopes of eternally rising prices we’re realists who accept the investment cycle.

But how times have changed! Our interpretation of “What do Investors really want?” is that investors really want steady returns without dramatic drawdowns if they can be helped. Big annual returns are nice and they will happen from time to time but if those returns come with -40% or -50% pullbacks just as frequently then investors would have no part of it. However, this type of volatility is exactly what you get if you’re a stock mutual fund/Index fund “long term investor” who’s strategy is to “buy and hold”.

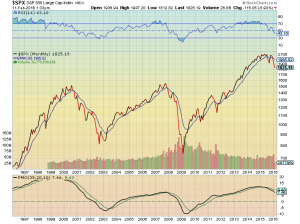

The chart above shows that the real rate of return for the SP 500 is a mere 1% per annum since 2000 which simply isn’t worth the risk if you’re a long term buy and holder.

Our primary issue with mutual funds or vanilla style advisors is that regardless of asset or style is that they’re all single direction oriented (they need a bull market to make money). Mutual funds don’t adapt and consider changes into the macro economic environment to adjust their holdings which would remedy the dramatic declines and sharply increase the chance that the investor will be a true long term investor but with an intermediate term perspective.

The old bromide that “the higher the return the greater the risk” is bullsh*t and peddled by funds and advisors who are limited by skills, experience or product. Our view is that you can sharply increase the annualized return on an investment simply by avoiding major bear markets and in turn earning a modest return during those years.

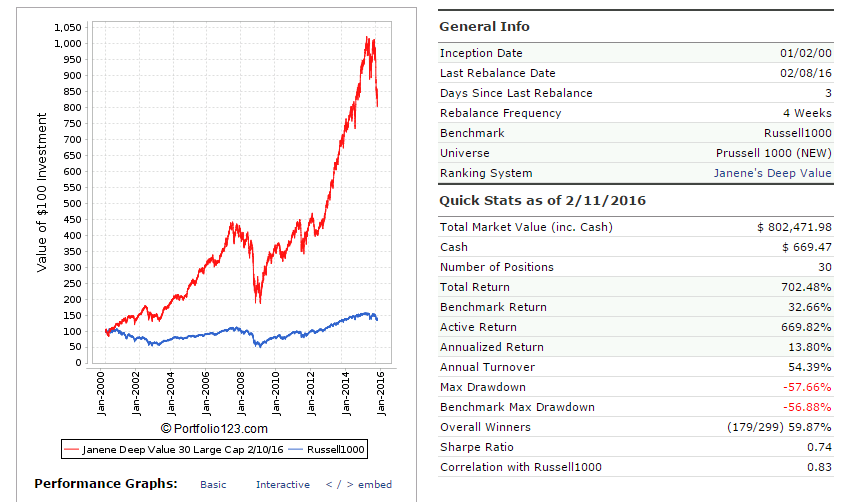

Below is an example of a simulation using our proprietary ranking and trading systems. Returns include all brokerage costs, including slippage and our 1.25% annual management fee. This system excludes all energy stocks as well as our list of black stocks (stocks that don’t fit our social screening criteria, or Vegan criteria). Keep in mind this is just a simulation and real results can differ.

The annualized return is 13.8% but the maximum drawdown is a whopping -57.66%. The benchmark Russell 1000 fell -56.88% so our system was not unusual given the decline in the benchmark. But even if you knew in advance what the long term return would be very few investors would have the stomach for a -57% decline.

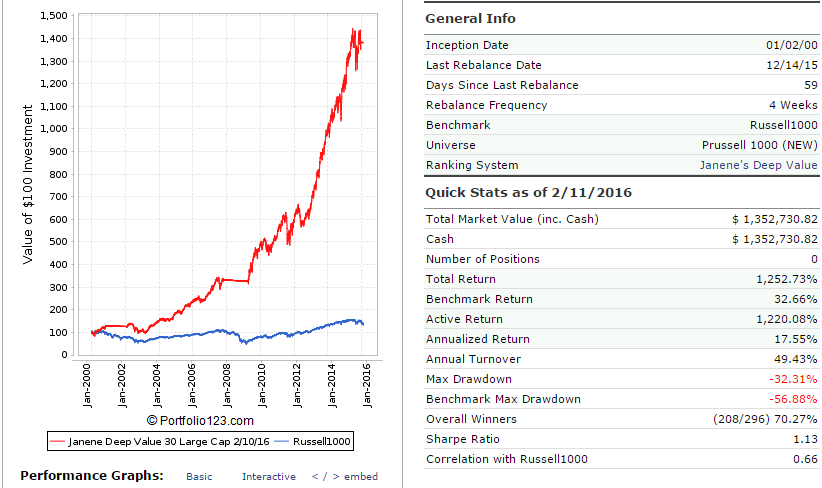

This is our offering of a better way to invest. The chart below is the same system mentioned above but with a macro economic filter that triggers when when reliable indicators of the onset of recession begin to materialize. Returns include all expenses listed previously, however we assume a 0% rate of return when out of stocks. In reality we would likely be invested in a mix of Treasury notes and bonds, plus inverted exchange traded funds. Inverse ETF’s didn’t exist back in 2000 so to maintain a consistent integrity of the simulation we use a 0% return.

By avoiding recessions the portfolios annualized rate of return jumps almost 4% per annum (assuming a 0% return when out of stocks) and the Max drawdown is reduced by approximately 25 percentage points. Even a drawdown of 32% is not a walk in the park but it demonstrates our point that the odds of investor success can grow significantly by avoiding high risk periods.

Naysayers to this point of view will say that its impossible to anticipate recessions. This isn’t true at all since shifting away from stocks when the US Treasury yield curve inverts, US manufacturing PMI dips below 50 or as shown in the top chart selling stocks when the SPX moves below the 10-month moving average have been accurate indicators of incoming recessions and major drawdowns.

Be careful out there

Brad Pappas