Client Update October 27, 2020

Markets always contain some degree of uncertainty. As investors we must accept risk to attain growth. But then there are extraordinary times when we’re faced with a significant binary outcome that can’t be ignored.

We’ve arrived at the crossroads of great uncertainty for the next two weeks. We have no particular edge whatsoever. This is why we’re sitting with such a high level of cash. We can be sure that we’ll eventually have an opportunity to invest heavily with high conviction, so best to keep our powder dry in the meantime.

Since we have the ability to get invested very quickly there is no need to bet on an election that could at best be a coin-flip. No need to step into the fray where the outcome is a myriad of possibilities.

Will the election be declared on November 3? Or, will it drag out into January?

Even if the election is declared and Biden/Harris are the winners, how will investors react because of taxation issues?

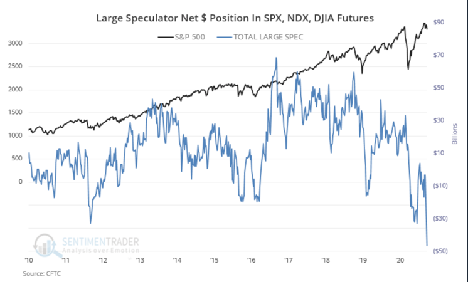

The issue with a Democrat victory is the possibility of a large retroactive tax hike on capital gains effective January 1, 2021. Investors won’t wait and see come 2021, they’ll likely sell this year.

In any case, market price, volume and direction will be a “tell” as to which course is taken.

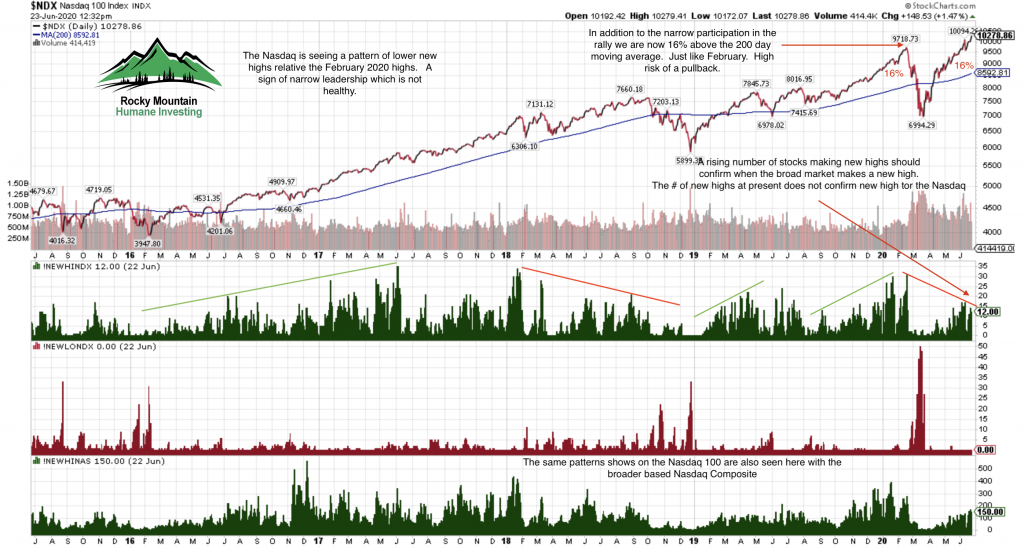

At present the Nasdaq composite has worked off its overbought readings reached at mid-month. The behavior of market leadings stocks remains very healthy. Yesterdays weakness emboldens buyers the following day with the opportunity to buy the leaders.

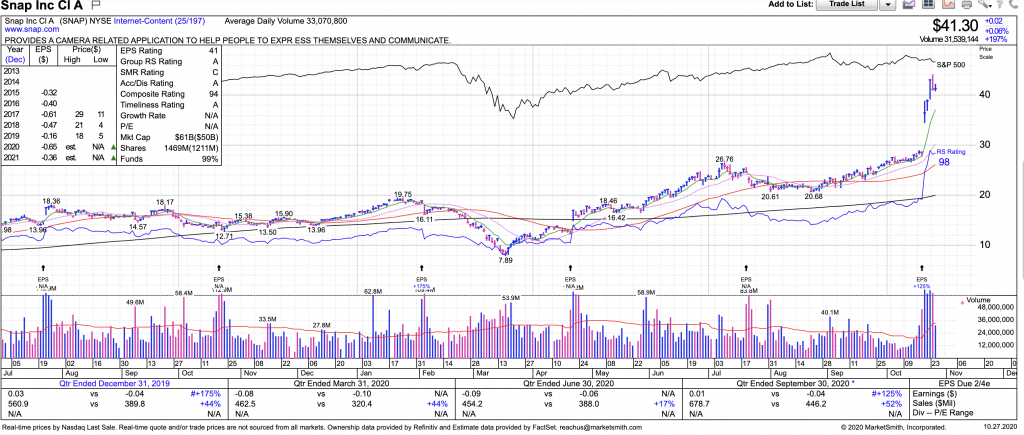

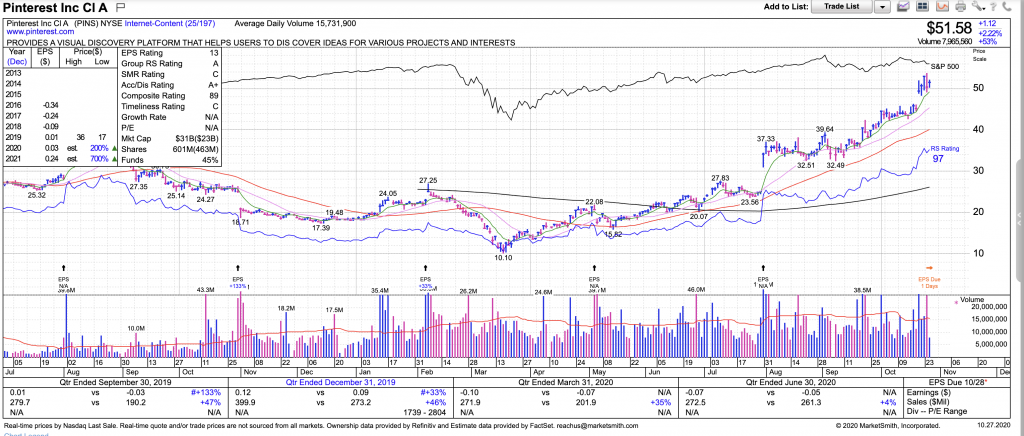

At present we own two stocks which may be a part of the next generation of social media leadership: Snapchat (SNAP) and Pinterest (PINS).

SNAP cost approx $31.6 versus $41.3 today.

PINS cost approx $42.62 versus $55.58 today.

Both stocks are going to be given a wide berth going forward as their price rise is similar to other social media when growth began to accelerate.

In addition, both companies were under-owned by large institutional investors which stamped into SNAP price be damned.

To Sum It Up: The primary market uptrend remains intact. But with a Biden/Harris win and Dem control of the House and Senate open the door for a large tax hike retroactive to January 1, 2021. Investors may sell heavily in the 4th quarter of 2020 to avoid the tax hike.

Either way, I don’t invest upon opinions and my models will trigger to the downside should heavy selling takes place. A large selloff wouldn’t be a bad thing in the long run anyway as it would set the stage for a better rally off a low pivot price in the future.

As Inspector Columbo once said: “One more thing…

“2020” enough said. Today is the first day I can head down into town in 11 days as life is returning to normal. We consider ourselves incredibly lucky that our town and home didn’t burn. We would look at the maps of the fires and find it astonishing that our little area was the hole in the donut of fire.

If you ask me, it’s all about climate change and especially drought. Our wells don’t fill at the same rate they used to. And, for the first time in 16 years that I’ve lived her our pond is dry.

Be Well. Be Kind.

Brad Pappas

October 27, 2020

Long all stocks mentioned.