Dear Client

I wanted to take a moment here to explain why we have so much cash uninvested at the moment.

The rise in the Nasdaq index is masking significant weakness in the S&P 500 index and the Russell 2000. The strongest Nasdaq names have gone parabolic – meaning they will likely revert downward just like a rubber band snapping back to form.

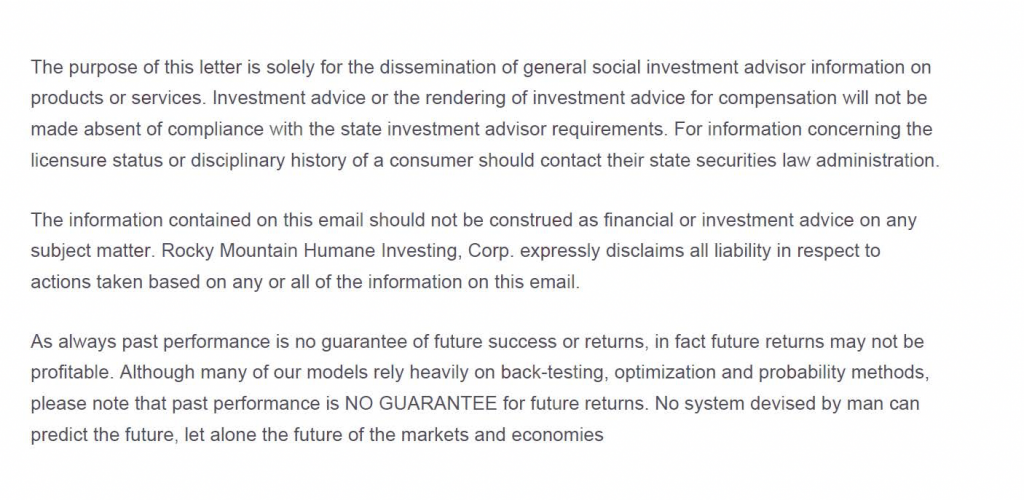

In addition, the Nasdaq is very extended and 16% above its 200 day moving average (dma) which was the same divergence at the February peak. There’s no rule that says it has to turn down at this point. The 2000 Nasdaq peak was 35% above its 200 day moving average. But a +16% divergence means the risk right now is terrible.

Eventually the Nasdaq and its 200 dma will meet again. Either by a choppy sideways trend or more likely a broad sell off.

In addition healthy bull market rallies will show an increasing number of stocks making New Highs for the year. Despite the Nasdaq being higher now than in February, there are far less stocks making new highs. This is not healthy at all.

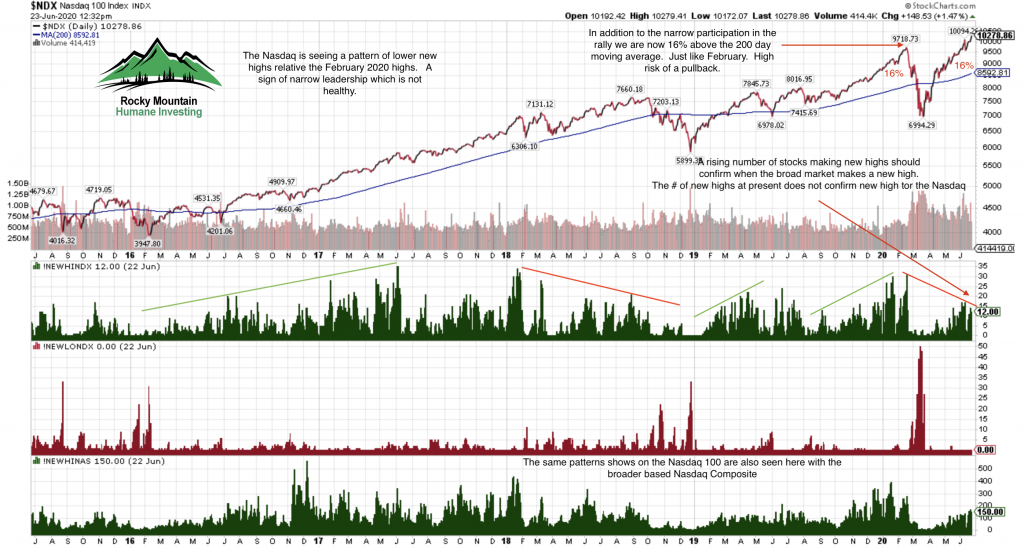

The lack of a broad base rally without all stocks in the various Indices participating creates a vulnerable market prone to failure.

It’s not just the Nasdaq showing poor participation. The S&P 500 is showing its form of poor participation. A healthy rally from the March bottom would be showing at least 50% of stocks above the 200 dma. Right now its just 42%.

If markets cool in the heat of the Summer I’d consider that a significant plus. I have no idea if the Nasdaq is putting in a long term top or not. A sell-off to its 200 dma could be an attractive entry point for Growth stocks.

In the meantime Banks (excluding Wells Fargo) and Value stocks, while extremely attractive, are languishing. The divergence between Growth and Value is remains the greatest since 1999. But it’s been impossible to predict a turn from Growth to Value. Whenever it does occur, the returns will likely be outsized.

Gold, which broke out of its trading range to the upside this week, would be vulnerable in any significant market weakness. When investors need to raise capital they’ll sell anything.

Summary: Expect significant market weakness soon. Many headwinds are likely ahead which are in the news on a daily basis. Last week’s 1800 point decline saw the Fed start the printing press again to prop up stocks once again. Regardless, markets need to revert lower for “the pause that refreshes”. Hence the risk right now is very high.

Be safe, Brad Pappas