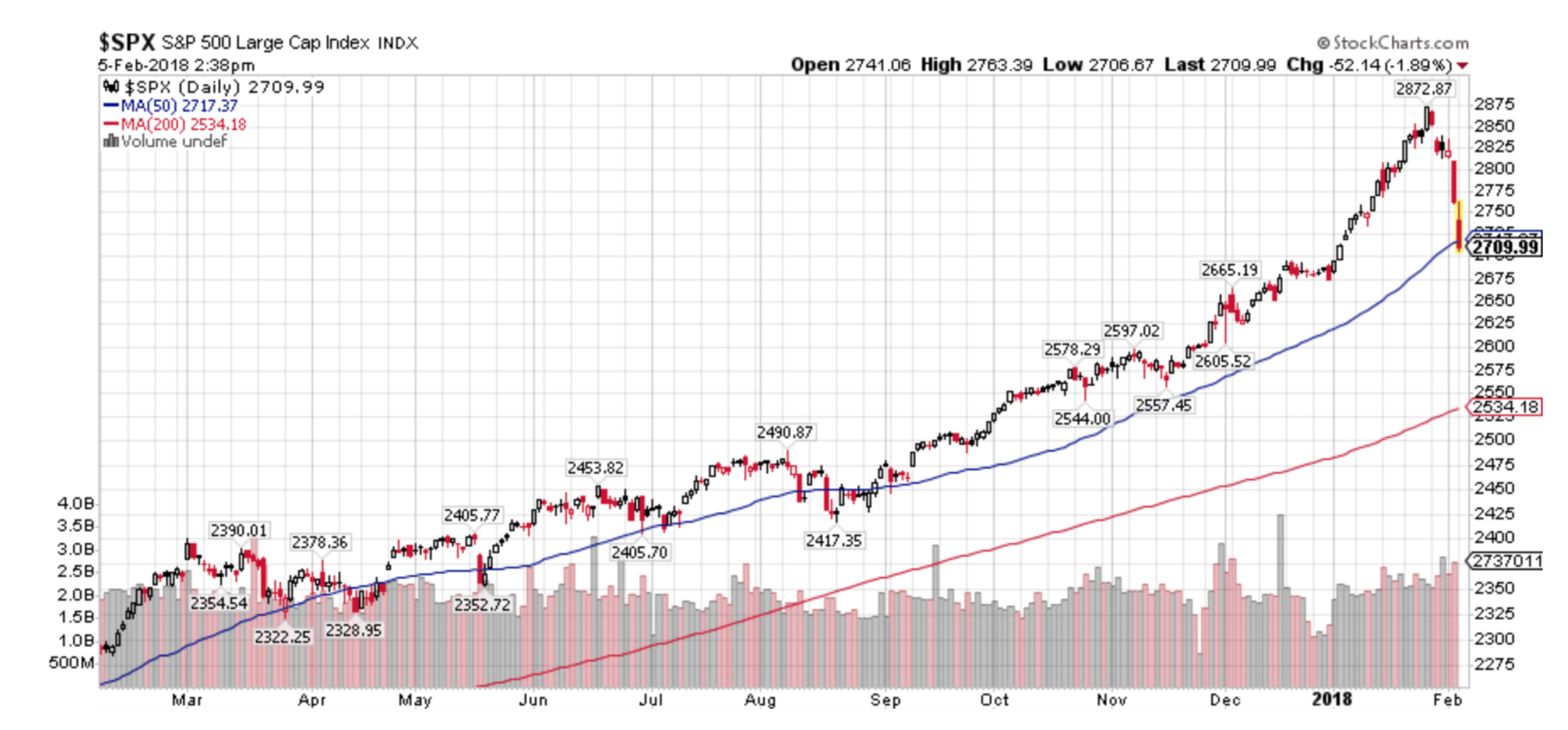

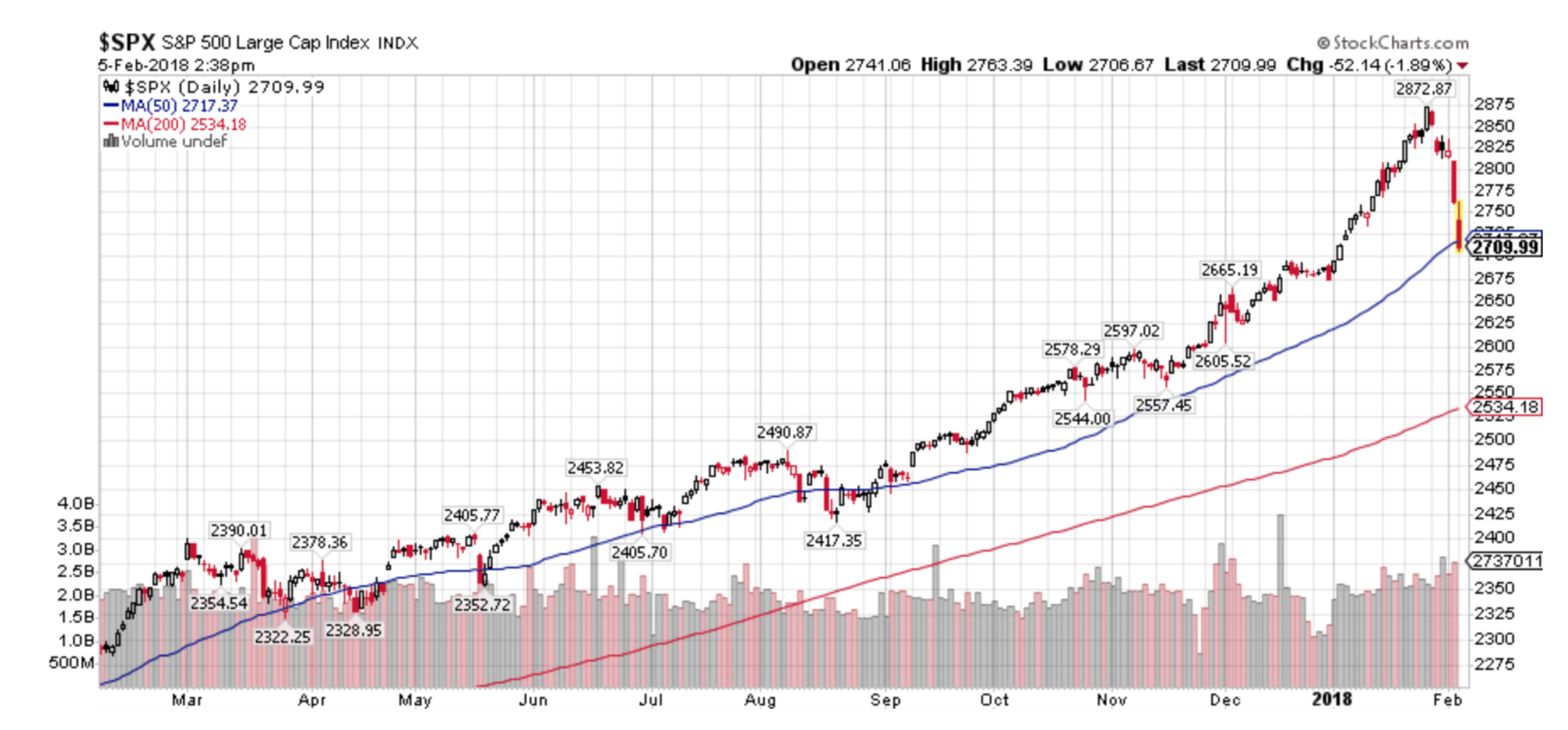

It has certainly been a wild three weeks after a peak to trough -11.8% decline in the S&P 500.

As we’ve been saying in our blog https://www.greeninvestment.com/blog/, during January we were trying to factor in the effect of emerging strength in the VXX along with rising interest rates due to a weak bond market. If you add to this a parabolic move in US equities, I felt that stocks could sell off sharply, which they did.

For our clients (which is reflected in our collective2.com model portfolio), we sold off approximately 40% of our equity holdings and added a 10% “hedge” by buying the emerging VXX to offset potential stock market losses should the decline occur. The downside to adding a suitable hedge to a portfolio is: should the market continue to rise any gains would be relatively muted or non-existent. I consider that a small price to pay to reduce potential risk and volatility.

To quote super investor Paul Tudor Jones: “The most important rule of trading is to play great defense, not offense.”

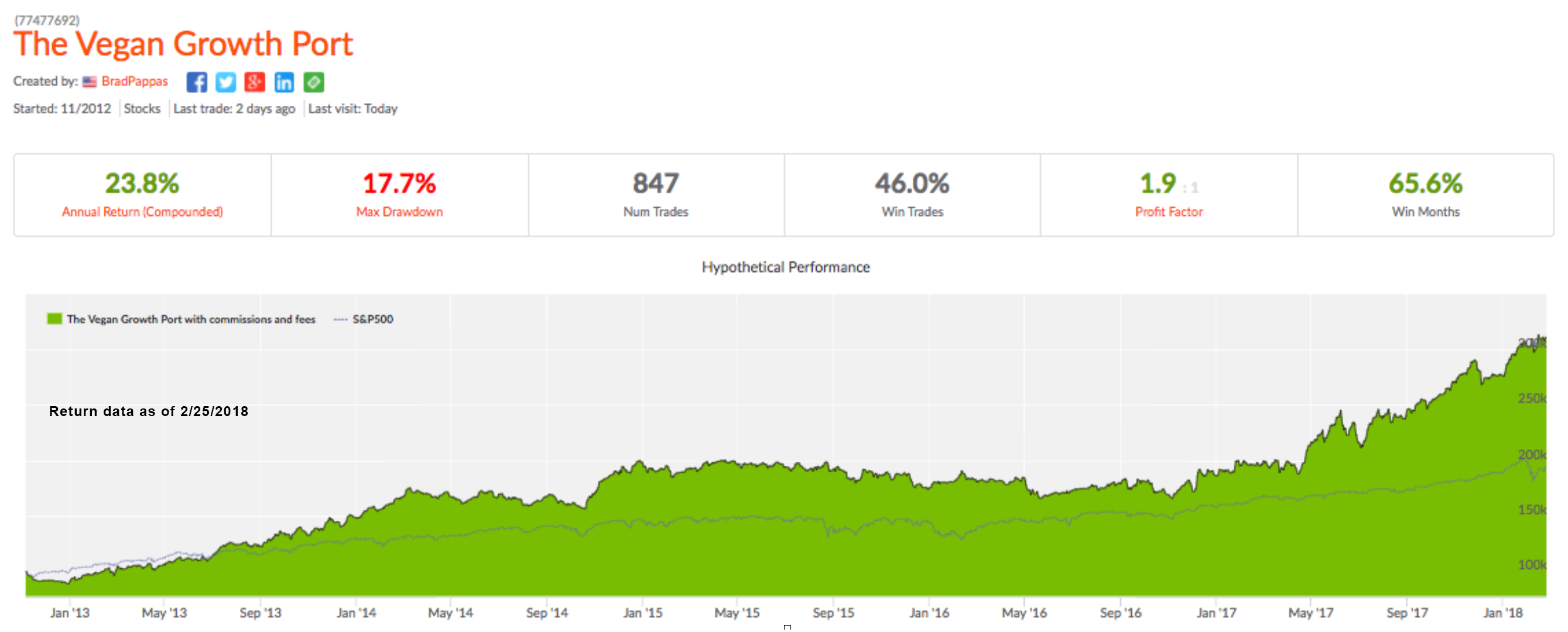

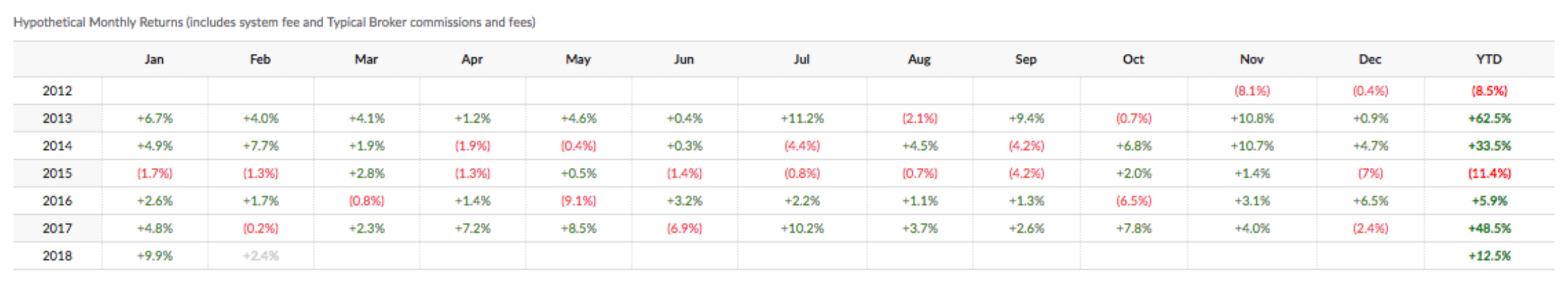

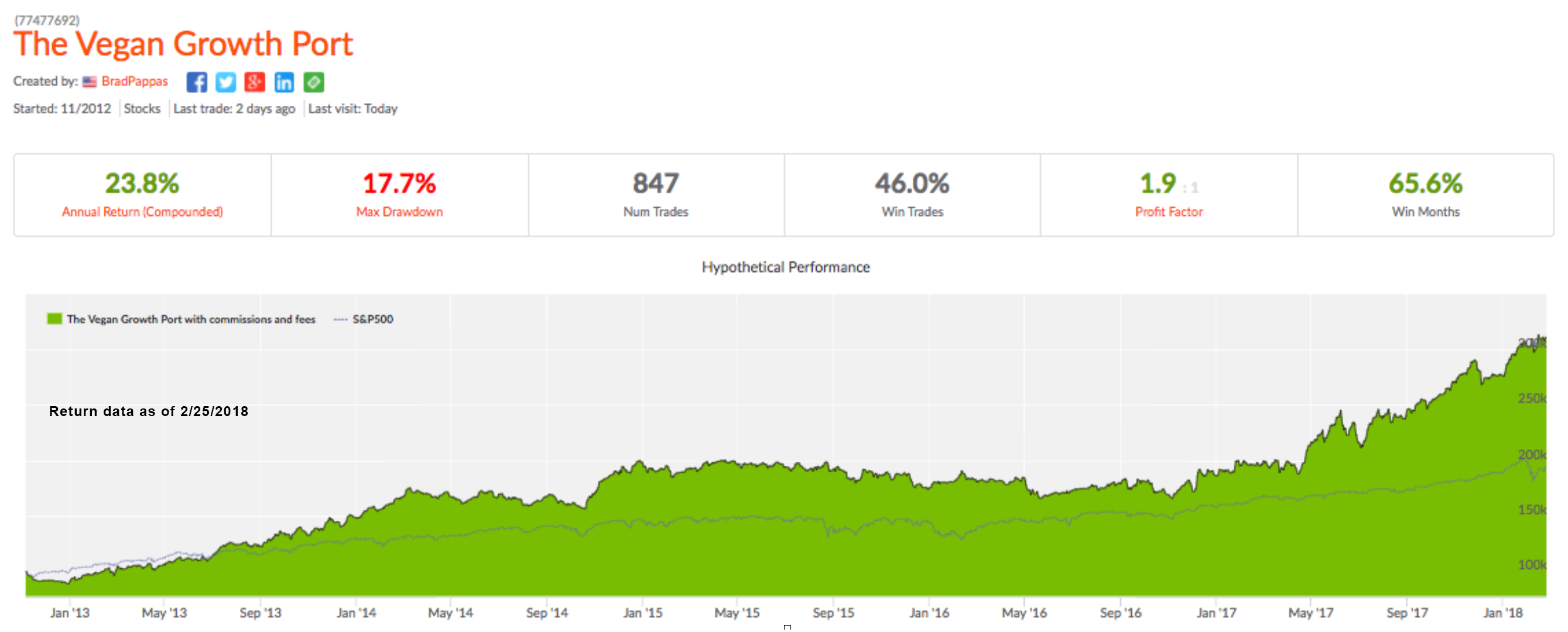

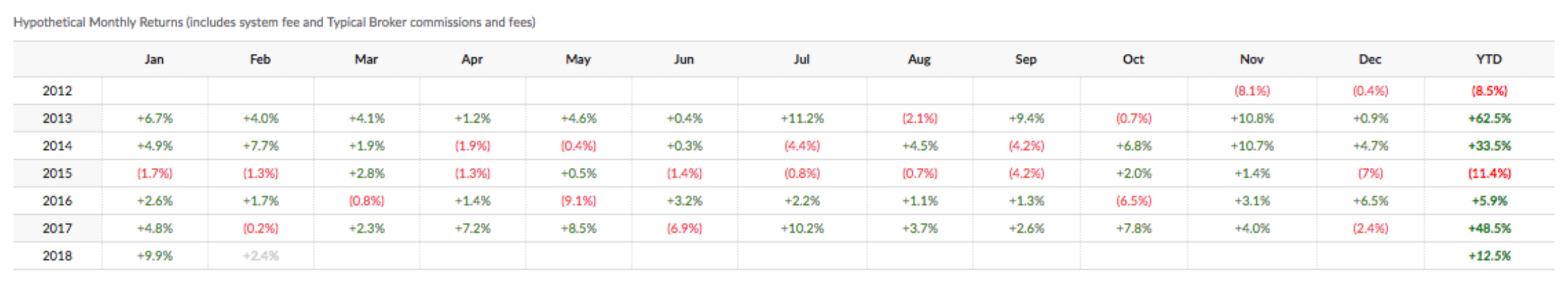

Client portfolios held their value and the Vegan Growth Portfolio model shows a positive gain for the year of 12.5% (net of all fees and expenses) versus 1.5% for the S&P 500.

A good advisor or investment manager should be paying attention to the many moving parts that could affect their client portfolios. In this instance, we were able to successfully anticipate the sell-off. That won’t always be the case and sometimes we’ll be wrong as well. I think it’s critically important for the long term success of our clients to act when we think the odds are good that we’re entering a high risk period.

Cheers,

Brad Pappas

President, RMHI

Brad@greeninvestment.com

970-222-2592

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.

Hello All

A quick update as to the happenings of the last week and a half and what to expect going forward.

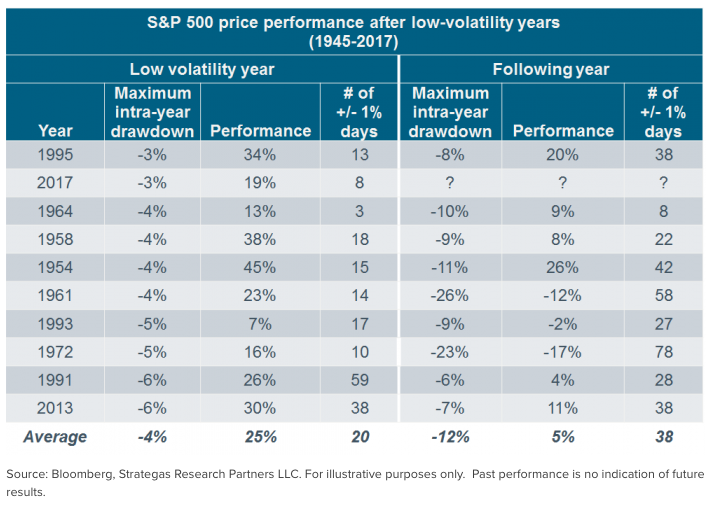

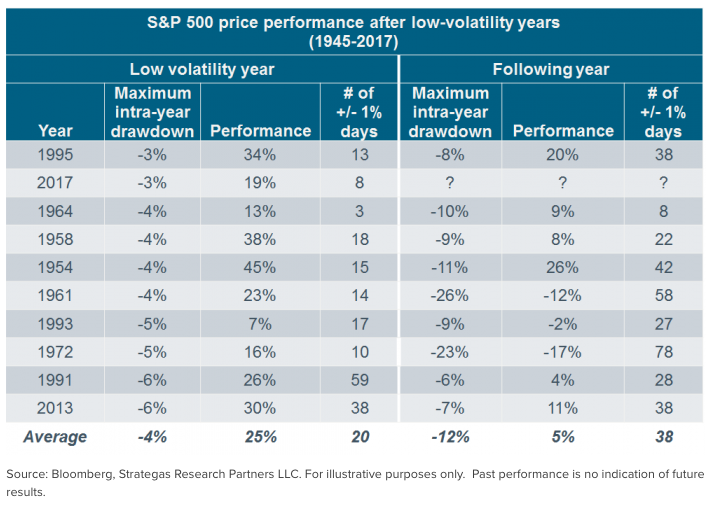

Paraphrasing Mae West’s “Too much of a good thing…is a good thing”, until it isn’t. In my early January letter I mentioned two events to look for: 1) a rise in interest rates and 2) the bursting of the low-volatility bubble. I wouldn’t have expected for both of them to come to fruition within a matter of days but that’s what happened.

The stock market vaulted into Parabolic mode in January and that’s a great thing until the music ends but by last Friday I had seen enough. On Friday 1/26 I began to sell heavily and adding the first round of what I expected to be a good “hedge”. The following Monday I sold off more holdings and increased our hedge to approximately 10%-15% or so of account size. I suspected the end of the parabolic rise or the market top was close, but it literally was those two days of selling.

The “Hedge” I utilized and as seen in your position statement at IB or Schwab is the “VXX” which is an exchange traded note based on the volatility measure known as the VIX. The VIX and VXX rise as market volatility rises. And, as a rule market volatility almost always rises as markets sell off. Since volatility had been declining for almost three years we were finally due for its return. I’ll never be known as a patient person but I had been sitting on this VXX trade for about six months. The Low-Volatility trade got so stupid that on my collective2.com platform there were people developing Low Vol trading accounts called “10% per month”. They must be kin to the Bitcoin “millionaires”. Eventually all things financial revert to their mean averages and volatility is no exception.

Last week I began buying the VXX in the $27.5 range and the close today was at $32.18. Today I sold approximately 25% of our hedges / VXX at the end of the day in the range of $31 as I expect a wicked bounce higher next week.

February 5 update: Another very steep decline today. I saw -1500 on the Dow at one point. We haven’t seen than in a few years and I sold off another layer of VXX into the abyss. These are the golden moments to lighten up on our hedges since the VXX price will drop sharply in a rally.

All in all, the rise in the VXX has been more than enough to balance off any losses in our remaining holdings. This morning’s weakness was expected as the retail investor tends to panic over the weekends and frequently sells at any price on Monday mornings. But this afternoon’s selloff looks like pure panic. Markets tend to make bottoms during moments like this.

So far nothing I’ve seen leads me to think the long term bull market is over. The damage being done now will generate a great deal of fear and selling which will be the fuel for the next leg higher in this market. I do believe we’ll revisit the highs by the end of the year unless there is a total breakdown in prices and trend. We’ll need to see a lot more selling and weakness to break the long term trend.

For the balance of the week I do expect at least a couple days of strong rallying which is why I continue to slowly sell our VXX into more weakness. These will be simple knee jerk rallies that don’t mean much. The market bottoming will be a process of market rally’s and sell offs that could take upward of a month or two. There is no need to rush back and buy stocks at this point.

Best of all, we’re sitting on a very large amount of cash in all accounts ready to buy at the right moment. One of the biggest values of proper hedging is the calm it can create which allows for clear thinking in chaotic markets.

Cheers,

Brad Pappas

Volatility ETN’s like VXX appear to at least be putting in a short term bottom. Eventually Volatility will increase and the VXX could rise substantially. Long VXX.

A short while back I decided to return to writing on the blog as a way to encapsulate my thoughts and review tactics and strategies. With the noise that exists within our culture and data driven industry we can lose ourselves to the impulses caused by the most recent data points.

The talking heads on TV uniformly speak with such clarity and conviction but are never held accountable to the results of their recommendations. Do they eat their own cooking the way I do? I doubt it very much. So while you the reader may consider that this blog is for your benefit please consider its also for my benefit at well.

What do we know:

The political leadership existent within the US and Globally lacks the political will and savvy to solve the debt and currency crisis. There is a continual sense that their intentions are to “kick the can down the road” for future leaders and tax payers. The lack of cross the aisle cooperation between parties is pathetic. The Republican’s lack of cooperation, even at the cost of benefit to the country in order to gain the White House appears to be the game plan. Speaker Boehner is even disagreeing with the proposed short term tax credits proposed in the jobs bill.

If you’re a country that cannot print money then you are crashing. Why this is lost upon the tea party, I have no idea.

There is a global race to devalue currencies. PIMCO predicts the Euro will fall to 1.20 USD within three to six months. When Janene and I were in Paris this May the Euro was 1.45 USD.

2012 estimated earnings for the SP 500 are coming down in deliberate fashion. In August the estimate for 2012 was $112, now they are at $110 and falling.

Most European stock markets are down 15%-20% while the US is down 2% for the year. Macroeconomic data continues to deteriorate. Last night Goldman Sachs lowered their end of the year target for the SP500 to 1250 down from 1400.

Investors are extremely bearish. AAII figures show 40% bears against 30% bulls. This is an uncomfortable status in light of my hedged positions. The issues of Greece, the Euro, our budget impasse, US debt, falling currencies and high odds of recession appear to be largely baked in the cake of many share prices.

Shares of dividend paying stocks look very attractive relative to bonds.

Contrary to Bernanke’s talk: US money supply is rising. Rising money supply frequently has a steroid effect in the short term for stock prices to move higher.

With Peyton Manning on the sidelines is there is no doubt that Tom Brady is simply the best at his position.

What I don’t know:

How low will SP 500 earnings estimates fall before they bottom? The average recession cuts earnings by 25% from the previous peak or in our case $75 a share.

While a Greek default is inevitable, can Europe handle a Greek default in an orderly fashion, and then an Italy default, followed by a Portugal default……..rinse and repeat.

Will the Chinese support the Euro to allow multiple currency options for its growth.

Can the European banks reduce their systemic risks and raise gigantic amounts of capital they require?

One potential cure-all would be for the Chinese to let the Yuan trade freely on its own merits? Is this just pie in the sky hopin and wishin?

Will investors finally purge Treasuries en masse and allow yields to rise?

Is our unemployment issue systemic (see Doug Kass) or cyclical (Paul Krugman)?

Can the opinions expressed by Tim Geithner in stating there will be no Euro Lehman’s be trusted?

How can Duane Allman and BB King be ranked higher than Eric Clapton in the Rolling Stone Top 100 guitarists of all time. I’ve adored Live at the Fillmore East since I was a kid and Riding with the King is superb but shouldn’t the breadth of work by Clapton be considered?

Long Clapton

I’ve received questions relating to account volatility so this post is probably well timed.

The purpose of our hedging strategy is to take a position in securities in the accounts we manage that will rise in value should the stock market fall. The value of the assets that increase in value should the market decline will offset the decline in the value of stocks, thus buffering the decline so you don’t take as big of a hit had you done nothing.

Essentially, we’re taking a much more aggressive approach to preserving account value by reducing downside volatility. Our hedging strategy does not include the use of Option or Futures. The value of the portfolio could still decline in value, especially on days where the stock market falls significantly but the decline would be a fraction of the loss had the account not had the hedges.

Should the market rise while the hedges are in place, the account would appreciate at a slower relative pace as well, since the hedges would act as a drag to upside returns.

I do not expect that hedging will be a frequent practice. Hedges are expected to be utilized with the Intermediate or Long Term market values are at risk.

This is our way of addressing account volatility in what I believe is the most effective way possible and I must admit, my response to doing our best to never allow a situation like our experience in 2008 to happen again.

My goal is to aggressively attempt to maintain account values near their highs by keeping declines to a modest level. We don’t need to be too concerned about making money when the market is moving higher, our proprietary model has done an excellent job of that. My motivation is to see that clients have some downside protection which also feels great when the market falls.

Be Careful Out There

Brad