Its been so long since a substantial market pullback occurred we can easily forget that market weakness is inevitable and part of the process. We do not see any significant reason to pull away from stocks as the factors necessary for a substantial market pullback are just not present. In the old days (facetiously written) an investor could expect 1 or 2 10% pullbacks and an average of 3.5 5% pullbacks a year.

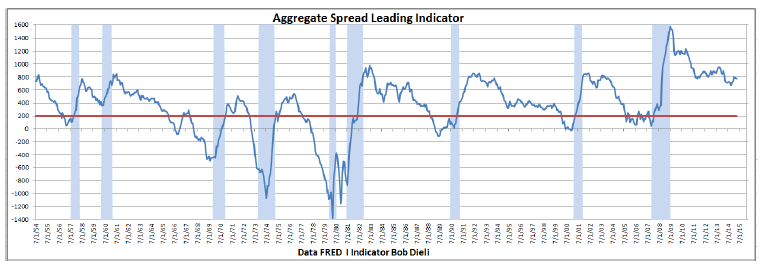

All recession indicators are saying we are quite a ways off from an economic peak and recession. Recessions don’t occur while employment is improving, they occur after employment stagnates during an economic boom.

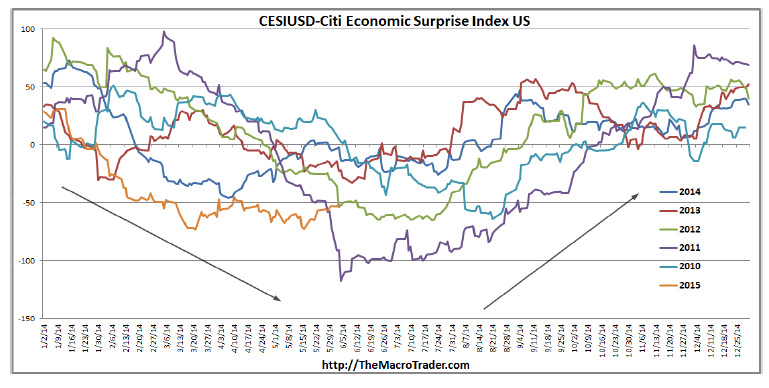

The strength of the economy remains consistent with leading indicators showing a pickup in economic strength in the second half of the year. Market valuations are on the high side which can be expected after a five and a half year run. Economic growth continuing and the expected Fed rate hikes to be incremental and soft, we think the market will continue to move higher later this year.

What really has our attention is the sell off in US Treasuries aka the Yield Curve moving higher. All Treasuries are now quite oversold and are beginning to become attractive once again.

We do believe the Fed will begin to raise rates and likely do it this year. In previous cycles, rate hikes have eventually led to a flattening and eventually inverted yield curves. We believe this time is no different, hence the widening of the yield curve created by the Treasury market sell off represents an opportunity.

What does make this time possibly different is the possibility of the end of the 35 year bull market in bonds and interest rates. Its possible that the yield curve could flatten with 20 and 30 year Treasuries remaining unchanged or possibly higher in yield. This could happen with a prolonged series of hikes in short term rates over many years. While we are flexible as to how this will resolve itself our thinking at this point would be to own 10 year or less Treasuries.