September 29, 2021

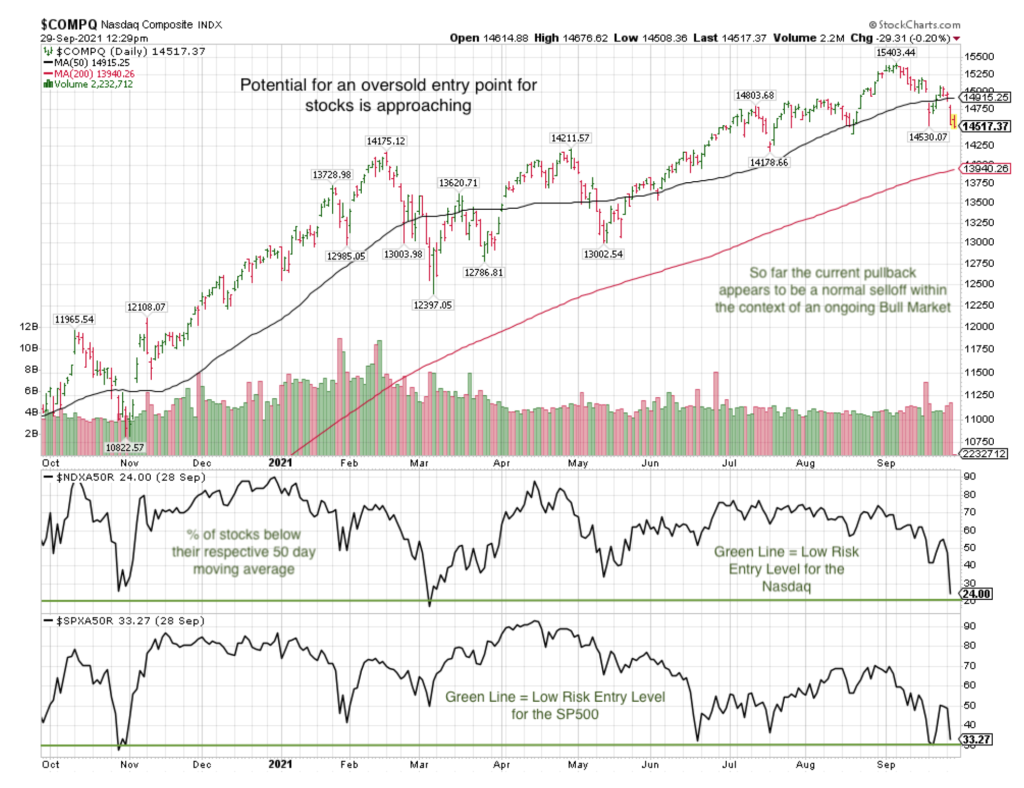

We are potentially arriving at a point where a good risk/reward entry point for stocks may present itself. There has been a frustrating lack of entry opportunities for equities this year. However the concerns regarding the Fed’s future change of course appears to be having the desired affect of stomping out excessive enthusiasm.

Fear is almost always present at market lows. Or, as long time market technician Walter Deemer used to say: “When it’s time to buy you won’t want to. When it’s time to sell you won’t want to.”

As much as I loathed the sell off for the past two days, it has created driven down the markets to the point where it’s time to think about adding to our holdings. At present we are in the weakest portion of the year for stocks. This will give way in approximately two weeks to the strongest seasonal tendency from October thru March.

It’s too early to do any serious buying today and possibly next week. I’ll continue to wait until buy signals appears before moving aggressively.

Changes to the stock selection and holding process

Markets are always in a state of evolution in trends. What worked in years past will likely not work in the future and visa versa. For most of my career in portfolio management I’ve changed strategies to fit and improve performance going forward.

It has been a difficult year for RMHI as it has been for the vast majority of technical trend traders. 2021 has been a year where a “buy and hold” approach worked well but only for a tiny majority of stocks. I’d place these stocks and their inherent characteristics in what I’d call “Stable Growth Leaders” or SGL.

The most common characteristic of SGL’s is their consistent moderately high earnings and sales growth. In addition, this category of stocks must also maintain performance greater than the market indices for a multiple of years.

I scan my screens daily for SGL’s but on any given day there might only be 10 to 15 that meet my parameters.

My strategy is to have at least 50% of account assets in these names, many of which are already in your accounts now. These are not intended to be traded actively unless they drop or rise precipitously, like Adobe Systems did recently.

Presently, the following meet my criteria and are in client portfolios today. So you know we only have partial positions in accounts right now. I’ll add to them should the market stabilize and begin to rally:

Entegris

Epam Systems Fortinet

Ihs Market Ltd Intuit

Johnson Controls SVB Financial Group

Current market weakness creates and ideal entry point for these kinds of stocks. While I’ve only listed 7 names, several more companies have fallen back in their buy zones.

With the exception of SVB Financial which is in the black for us. The other holdings have moderate to small losses. Thats ok for now. These names have repeatedly bounced back from sell-offs in years past before resuming moderate and steady appreciation.

The balance of our holdings will be the classic technical trading that works very well in strong markets.

In creating this form of hybrid methodology is an effort to create more balance where at least one strategy could be working while the other does not.

In addition, both technical and SGL’s will work initially after a good market sell off like we’re in the midst of right now.

Thank You,

Brad Pappas