Trying to call a market top these days is like listening to a Neocon predict strategic choices, the outcome will either anger you or cause you to shake your head in disbelief. I’ve been relatively quiet the past few months because there has been little new to talk about. We have a very uncommon stock market that ever so slowly grinds higher making fools of those who try to call market tops. There are times when investors must simply do nothing. Rather than stare are your holdings, go for a walk in the sunshine, watch the World Cup – trading slows to glacial speed when the games are on, except for the commercials. If you’re like Paul T. Jones who makes his living off volatility you can fantasize about being on Dancing With The Stars.

The old adage “You can be right, or you can make money” has never been more apparent. This market is hated by many, these are the folks who’ve been negative on stocks for quite a while who insist that doom or at least a market correction is near. The problem is that in the meantime they’ve lost so much ground sitting in cash earning 0% that they likely could endure a decent market correction in the future and still have more profits than had they stayed in cash.

On Saturday, my wife and I were having brunch at a local Boulder spot called Tangerine where I happened to overhear a conversation between a couple the next table over. A woman was fretting over when to sell her stocks to avoid a market downturn. Most amateur investors view selling their stocks and going to cash or alternatives as a single dimensional when in fact it isn’t. What happens when a person decides to sell and a few weeks later realizes they made the wrong choice? Taxes aside this is an expensive mistake, do they become entrenched in their belief that “the market is so relentless that its bound to top out, so it was a good decision”? At what point do they give in and realized the mistake, 5% higher, 10% higher or more?

As a basic rule of thumb I wouldn’t be overly concerned about stocks until the yields on Treasury Bills and Bonds become inverted (the yield on the 20-year bond is lower than the yield on a six month T-Bill). Sure, we’re eventually going to have a market correction but the timing is impossible to predict with accuracy at this point.

If you find comfort with an academic study of this issue I’d suggest: “Predicting the Bear Stock Market: Macroeconomic variables as leading indicators” Chen, 2009.

Or, visit the Cleveland Fed: http://www.clevelandfed.org/research/data/yield_curve/

Brad Pappas

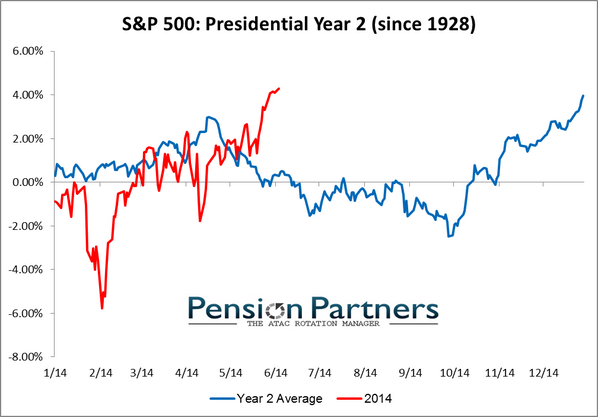

Our reasons for redeploying assets in the last three weeks become clear with this chart. We did well with our hedging strategy in March and April but a funny thing happened on the way to a substantial correction. Markets have stopped short of the long awaited pullback and the rally continues.

Tip of the hat to Charlie Bilello.

We’ve just uploaded our 2nd quarter letter.

The Waiting Game

This may not be a good market for investors but its a fine one for traders. Over the past months we have maintained a cautious tone with the expectation of a potential April top for US equities. While we don’t expect anything dramatic in terms of a sell-off, the selling could be substantial at times as the markets begin to flush out newbie momentum investors or those who need a refresher course in market risk.

As for this being a fine time for nimble traders, this has been the case especially in the Nasdaq and small cap sectors as identified by symbols QQQ and IWM, both of which have rolled over and are leading on the downside. We’ve been able (so far) to capitalize on the the weakness by trading the SQQQ and the TZA as both markets appear to be in a “two steps down and one step up” mode.

Eventually this period will pass and fear will be reinstated as a common investor emotion which will probably lead to a strong second half of 2014. At present, we see no signs of recession and weak markets within growing economies can happen but they’re typically shallower and briefer than recession based bear markets. So, assuming the markets remain with a downward bias into the Summer, this will likely lead to an excellent entry point later this year.

Notice the divergence between the stodgy S&P 500 and the NASDAQ and IWM. This kind of behavior leads me to suspect that the outpeformance in the small caps may potentially be over which is one why we’re expecting to lean heavily on Mid Caps when we eventually move to fully invested.

So far we have avoided shorting the SPY via inverse exchanged traded funds, we’re respecting the market strength.

We continue to opportunistically trade the SQQQ, the inverse QQQ ETF as this market shows a bearish trend. I’d expect to sell the SQQQ in the event the QQQ revisits $84.

We are trading the TZA which is an inverse exchange traded fund that mirrors the IWM which is a proxy for the small cap stock market. We expect to sell the TZA if the IWM moves below $111.

To sum it up: For the time being, this is not a market for investors but for traders. This too shall pass.

Brad Pappas

Long TZA and SQQQ

We have sold all of our positions in TZA, SQQQ and TMF today for a nice short term gain, the TMF was a push.

Today’s knee-jerk sell off on less than favorable employment data, IMO should be viewed with the larger perspective in mind. The employment data miss likely means that easy monetary policy will continue which is quite positive for the market.

I felt this round of hedging was a bit of a struggle in light of the strong markets so today’s sell-off is a bit of a gift. I’d rather take the profit in hand than wait for what I expect to be cooler head analysis next week.

Brad Pappas

Well, I thought I would be the first to quote from the eye-rolling Gwyneth Paltrow press release in the financial media as this is our way of graciously leaving the bull market rally that began in late 2012 but without the need for a starvation cleanse or $500 yoga pants.

Since December I’ve been harping on the potential for a serious market top in the second quarter of this year. At the time I only had market seasonality, the longest period without a pullback to the 200 day moving average since 1995 and the absurd level of investor bullishness to lean on for my rationale.

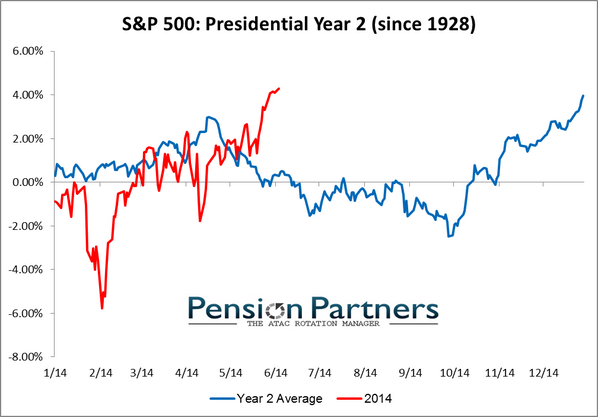

This chart alone is quite damning evidence based on past precedents that we could be in for a rough time for the next six months if we don’t take action.

At present we’re seeing action in the Treasury bond market that belies current equity market strength and is leading me to believe that last week’s feeble rally in stocks was perhaps the last gasp of the rally.

If we were in a strong equity market as we saw last year there should be no rally in Treasury bonds, in fact Treasuries should be quite weak. But as the chart below reveals the Treasury market is in the midst of a serious rally.

Our thinking is that we’re in the early stages of a market sell off, which at minimum corrects down to the rising bottom pattern in the chart below (red line). Ideally, we’d like to see the sell off move down to the trailing 200 day moving average (blue line). This would represent a sell off of 7.5% and bring some much needed negativity back to the markets. Market rallies are born from significant market negativity and fear not the “trees grow to the sky”state of mind.

We’re able to be Goop-ishly serene about the potential for market weakness since by mid March we had approximately 40% of client assets in cash and almost 100% in cash for new accounts. This past Tuesday we hedged our equity holdings by initiating positions in two inverse exchanged traded funds (TZA and SQQQ) and recognizing the new rally in Treasuries added to our position in the TMF. In addition we cut back our positions in small regional banks since the rally in Treasuries has a hint of “inverted yield curve” which is quite negative for the banking industry. Lastly we cut our position in Arotech in half since it has spiked as high as $6 in recent trading.

There are times when we should be as aggressive as possible to make gains for our customers and clients and then there are time to to step back and have some chamomile tea, I’ll have mine with Stevia.

Be careful out there

Brad Pappas

Long TZA, TMF, SQQQ and ARTX