The Shipwreck of ARK and The Epicenter Stocks

March 8, 2021

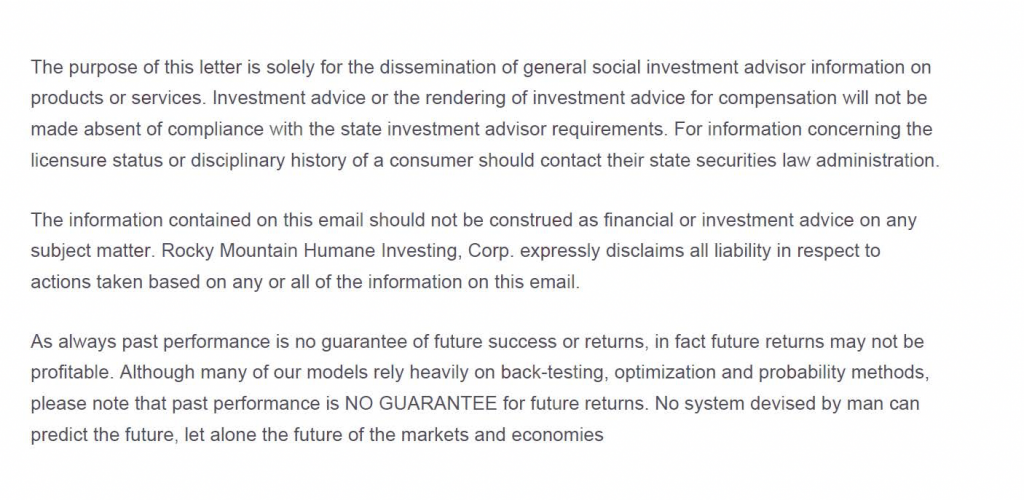

We are in the midst of the largest rotation from Growth stocks to Value stocks in the past 21 years. You’d have to go back to the Tech Bubble of 2000 to find anything like the present situation. Stocks that were formerly beloved like Tesla falling from its high of $900 a month ago to $539 today. But beneath the surface there is significant strength.

The trigger for this has been the rise in interest rates that continues to accelerate. No doubt the eventual demise of Covid is the tail that wags the bond market which is wagging the stock market. The 10-year Treasury yield has rising from 0.95% to 1.62% since the start of the year. This increase may not seem like much but its very important when it comes to stock and market valuations.

When interest rates were under 1% (which means the risk-free rate of return) high flying Growth stocks were the place to be since valuations meant almost nothing. Once the risk free rate of return began to rise (and we have no idea how high it will go) it meant that the High Growth sector would no longer be compared to extremely low interest rates. Higher risk free rates brings down the value of every investment vehicle including real estate and businesses.

Growth stocks frequently have only minuscule or no earnings whatsoever.

Those kinds of stocks can implode since their valuations are overextended. This combined with the reckless buying by the ARK funds has created an extremely volatile situation for Growth stocks.

Plus, Growth performance relative to Value became the most extreme since 2000, so something bad was bound to happen. And, mean reversion is brutal. If an investor had not lived and traded through 2000-2006 they would have no idea how bad it can get. Psychologically, new investors have a hard time understanding why a great Growth stock can suddenly become toxic. In those cases small losses probably become big ones.

The ARK shipwreck

Case in point: The ARKK Exchange Traded Fund run by the star of this era Cathie Woods. Just over a year ago the ARKK ETF had $10 Billion in assets. As of a month ago ARKK managed $60 Billion. Almost every investment manager or hedge fund keeps a very tight lip on what holdings they own. ARKK actually publishes a daily list of what she’s buying or selling. This is extremely

dangerous because ARKK purchased such a high percentage of some companies that she cannot liquidate her shares in a reasonable time.

The ARKK fund presents a systemic risk to Growth stocks. When ARKK’s assets were growing exponentially Cathie Woods and ARKK continued to buy and buy to absorb the incoming cash. Thus driving up prices exponentially as well.

The risk to ARKK is that the liquidation phase as investors withdraw their capital. Clients withdraw assets as ARKK shares decline, thus ARKK is forced into selling its holdings which creates more losses. Open ended ETF’s like ARKK cannot put a hold on client withdrawals the way a hedge fund can.

To compound the issue, in Japan a financial firm was formed to mirror the trades of ARKK for their Asian clients.

ARKK also has other funds in its quiver. For just March 6th: ARKQ had -$96mm withdrawal, ARKW -$197mm withdrawal, ARKF -$94mm withdrawal, ARKG -$183mm withdrawal. Oddly ARKK had +$48mm inflow. Net Withdrawal for March 6th was -$524mm withdrawal.

So if another financial firm were managing their Growth portfolio responsibly, the unholy cycle of ARKK spreads to other firms as well. These other firms can get sucked into the vortex of forced selling of Growth stocks.

Growth must be avoided until this business with ARK is over. Fortunately for us, ARK never invested in Value at all.

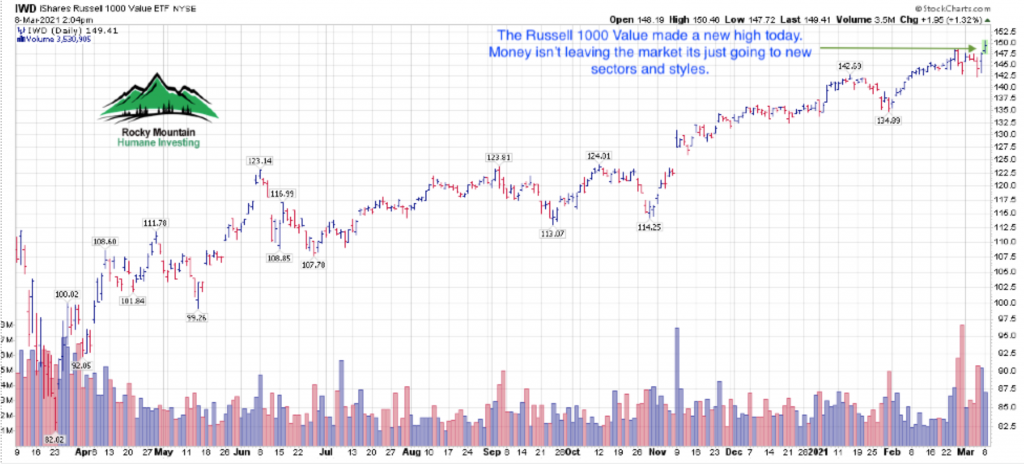

So at present my proprietary market models are on a Sell for the Nasdaq and for the Growth sector of the S&P 500 and Russell 1000 IWF.

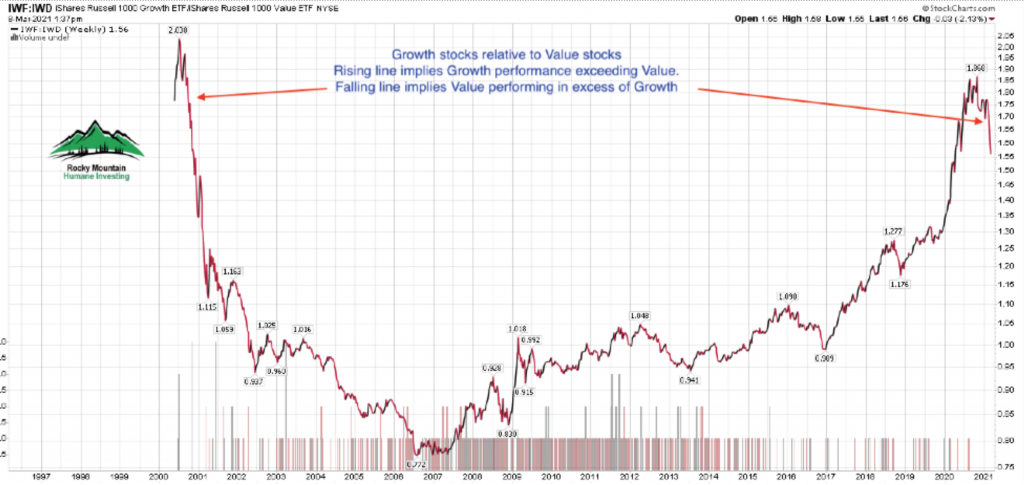

And because we have a bifurcated market I have a Strong Buy for the IWD or Russell 1000 Value and S&P 500 Value.

Present Strategy: I really don’t want to say that Growth stocks are dead money for a long length of time but it’s very likely. Growth is much less attractive than the “Epicenter” stocks.

Stocks have bifurcated to the point where a broad based index thats naturally biased to Growth stocks will give me a Sell signal. However once I switch to Value indices I see a very strong group of companies worthy of investment.

I’ve been expecting a mean reversion from Growth to Value for close to a year. It’s happening in a big way and I expect it to continue.

Money is not necessarily leaving the stock market when it sells off, they are rotating. Large investors are rotating from high Growth to Value. Value is the place to be since it benefits from higher interest rates and the retreat of Covid from our lifestyle.

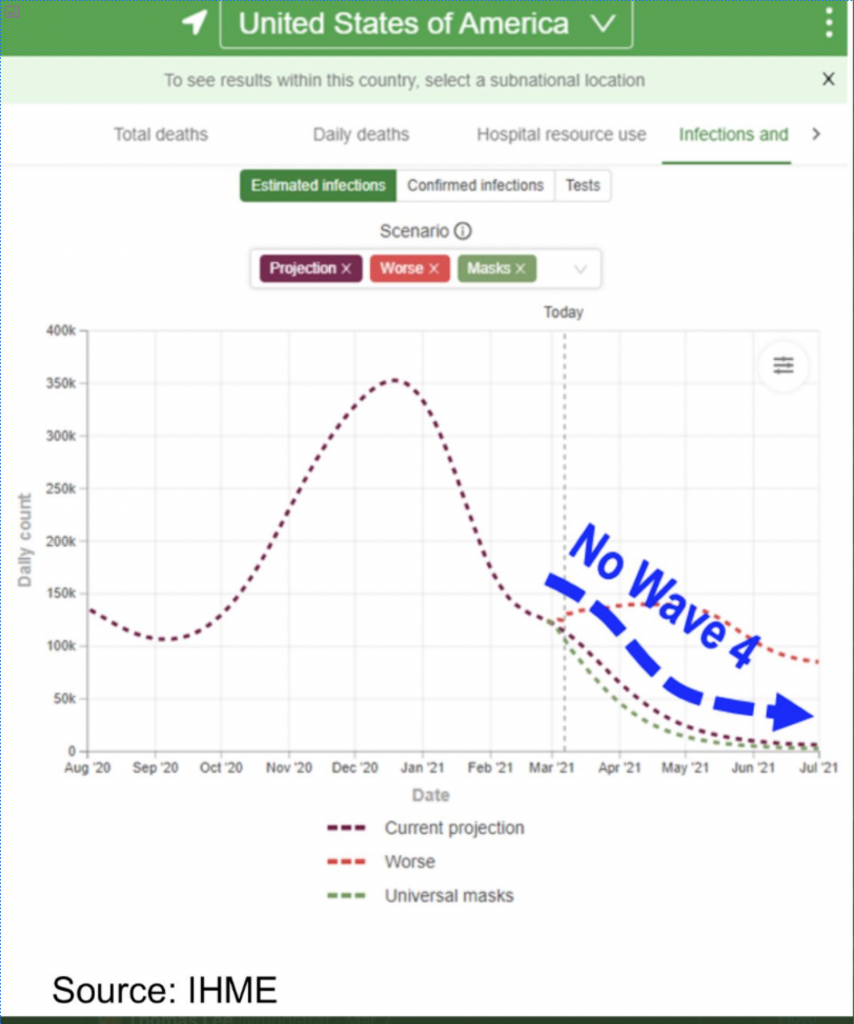

Data is strongly suggesting that Covid daily cases to drop by 50% by early April 2021. And, fall close to zero by May 2021. This is why the “Epicenter” stocks are so attractive. You and I and everyone else is going to fly, go on vacation and visit restaurants and malls once again.

Be Well. Be Kind.

Brad Pappas

March 8, 2021

Long all stocks mentioned.