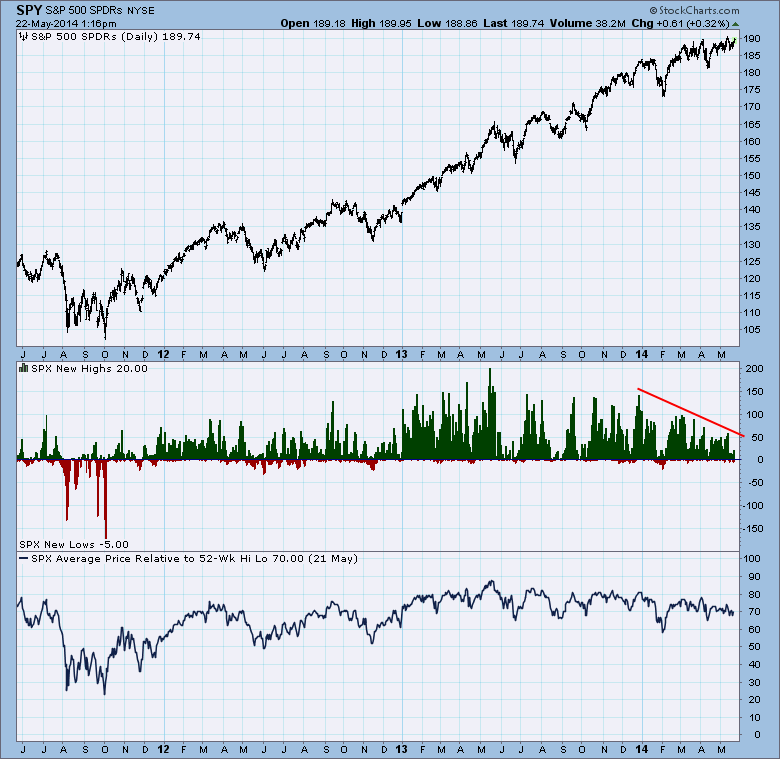

Under normal conditions I’m decidedly positive or negatives regarding US equities. While I’m positive in the longer term time frame (one year) I remain cautious in the shorter time frames. My prime reason for caution in the short to medium term is the declining number of stocks making new highs.

In general, when we see the number of new highs in the S&P 500 index declining we can assume that the rally is very mature and a cautious posture is prescribed. Likewise if we see an increase in the number of stocks making new lows we can safely assume that there is internal erosion occurring even if the major market indices show little or no weakness.

Our quandary today is that we do see a reduction in the number of new highs, the top coinciding with the peak in investor enthusiasm in December. But we are not seeing an increase in the number of new lows.

Due to the erosion in the number of stocks making new highs in the SPX we’re sticking to a neutral posture for the time being while reserving enough cash on the side to hedge our long positions should the SPX break to the downside.

Be careful out there

Brad

No positions