Driving Forward Thru The Rear Window

August 2022

The recent stock market rally over the last month garnered most of the attention from investors. The idea that just because the Treasury bond market has stabilized its now time to buy Growth Stocks is foolish. Buying due to lower rates works when the Fed has your back but its lethal when they’re not. This is typical of investors who don’t know any better and desperately need Fed stimulus to push stocks higher. The problem is the Fed is now doing the opposite with restrictive policies that are toxic to stocks but ideal for Treasury bonds (T-Bonds).

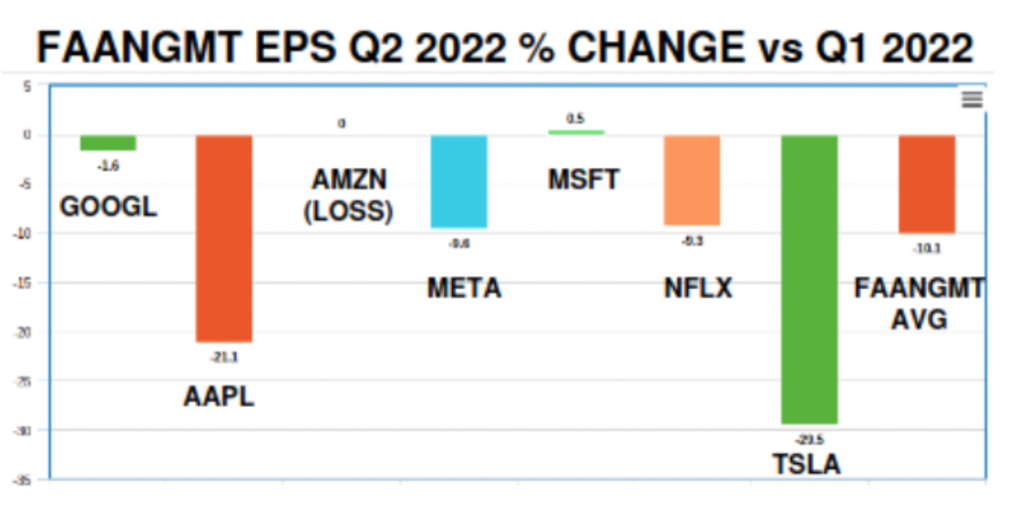

Earnings for these Growth stock giants are down 10.1% sequentially. Earnings are declining and thats what we would expect in a recession.

Nvidia could be added to the list. The semiconductor giant reporting Q2 revenue $6.7B versus estimate of $8.12B.

The Federal Reserve is fully focused lagging indicators like the Consumer Price Index and employment. The CPI is a reflection of past data and it takes 6-9 months for the rate hikes to have their effect on the economy. So the Fed can easily overshoot their objective of reducing the CPI. This also means they’ll place the country into recession (assuming we’re not in recession).

Since the data of the US going into recession is increasing prices for long term maturity Treasury bonds are rising. Even though the Fed will be raising short term rates, longer term rates are controlled by the open market. Yields are falling because present policies will cause a recession which will force the Fed to lower interest rates in 2023.

T-bond markets are forward thinking while the Fed is monitoring rear view data.

This is the most important chart I can show you. When the yield on the 10-year Treasury bond moves below the 2-year Treasury bond its called “Yield Curve Inversion” or YCI. YCI has a great history of being a forward indictor of rising unemployment, recessions and falling stock prices. The YCI has correctly anticipated every recession for the past 50 years.

When the Yield Curve inverts it’s a signal that interest rates will stop rising and T- bond prices will rise. This is why our highest asset allocation is to Treasury Bonds.

Recently RMHI became a client of Michael Belkin of the Belkin Report. Belkin created his proprietary forecasting model at UC Berkeley and further refined it as an analyst at Salomon Brothers. His institutional clients manage just under $2 trillion. From my perspective he is one of the best.

Based on his modeling:

- Treasury bonds have exited their bear market which stocks have only just entered.

- Recession “Our model forecast continues to point straight down for real GDP growth and corporate earnings, which are ultimately the determinants of stock prices. The forecast suggests the recession is just starting and will continue for 12-18 months. Sell stocks, buy government bonds.”

- The current bear market in stocks is only about 1/3 finished. Nasdaq could fall 60% from the November 21 peak. The S&P 500 could fall 50%.

- How best to position oneself for the near term future? Exactly what we are presently doing. A. Own Treasury bonds. Belkin expects the “TLT” Shares 20-30 year Treasury bond ETF to rise 15% to 20%.

- When stock markets make temporary bounces higher add our 1x shorts (that benefit from falling stock prices) “SH” “RWM” and “PSQ”.

- “Market psychology currently equates lower government bond yields with stock market optimism, especially for tech stocks….We disagree. Thats now how it works in a recession. Go back and look at 2000-2002 or late 2007 to early 2009. Tech stocks and the market got creamed while T-bonds rallied because the economy and S&P earnings collapsed. That is probably wha we’re setting up for again. Sell stocks and shift into government bonds.”

Belkin notes that there will be a shift in investor psychology away from stocks to T-bonds based on fear of a falling stock market. (This always happens in major bear markets. Investors give up hope in stocks and gravitate to the safety of T- bonds. As a result when the stock market eventually bottoms they’re too scared to return to stock and wait till the rally has already moved a great deal.)

As Stanley Druckenmiller has said: “Never, ever invest in the present……You have to visualize the situation 18 months from now, and whatever that is, that’s where the price will be, not where it is today.”

Thank you for reading

Brad Pappas

August 9, 2022