September 6, 2022

Both stocks and bonds have declined since my last note to you from August 26. The Fed must correct the excesses created by the Fed during the Covid crisis. The official US response was $9.5 trillion of stimulus ($5tn fiscal and 4.5tn monetary stimulus). This amounted to 38% of GDP.

To put some perspective on how excessive the Fed was: During the financial crisis of 2008 the total fiscal stimulus was 5.7% of GDP (source St. Louis Fed) and monetary stimulus was 9% of GDP (Source Fed balance sheet). Added together there was a total of 14.7% of fiscal and monetary stimulus relative to GDP. And according to Brian Belkin there was no exit plan.

So, total Covid stimulus was 2.6 times larger than the 2008 credit crisis. I’m not even going to add stimulus data from the European ECB and other entities.

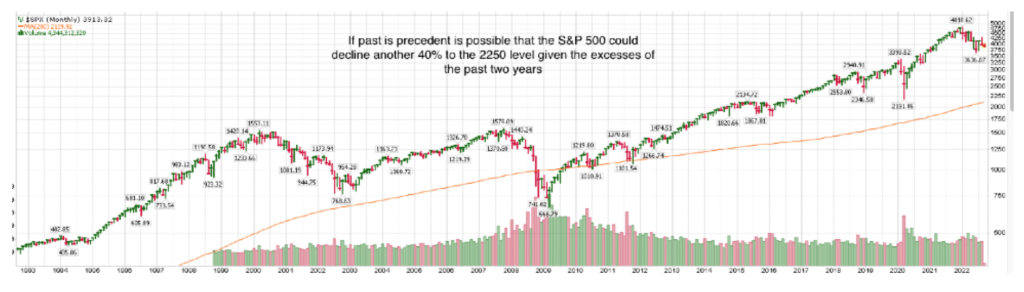

As the chart above shows given the excesses of past years its possible there is much more downside risk than investors are expecting. The 200-month moving average which is at 2250 could be reached. Thats another 40% down since at present the S&P 500 is at 3900.

Plus, Treasury bonds which have been very unforgiving have already pulled back and gone below their 200 month moving average.

So thats where we are, doing nothing and remaining patient. I still believe there is a moving coming in Treasury bonds but I have no idea where or when it will begin. My guess is that for bonds to move higher it will take another gruesome decline in stocks.

Thank you for reading

Brad Pappas