It has certainly been a wild three weeks after a peak to trough -11.8% decline in the S&P 500.

As we’ve been saying in our blog https://www.greeninvestment.com/blog/, during January we were trying to factor in the effect of emerging strength in the VXX along with rising interest rates due to a weak bond market. If you add to this a parabolic move in US equities, I felt that stocks could sell off sharply, which they did.

For our clients (which is reflected in our collective2.com model portfolio), we sold off approximately 40% of our equity holdings and added a 10% “hedge” by buying the emerging VXX to offset potential stock market losses should the decline occur. The downside to adding a suitable hedge to a portfolio is: should the market continue to rise any gains would be relatively muted or non-existent. I consider that a small price to pay to reduce potential risk and volatility.

To quote super investor Paul Tudor Jones: “The most important rule of trading is to play great defense, not offense.”

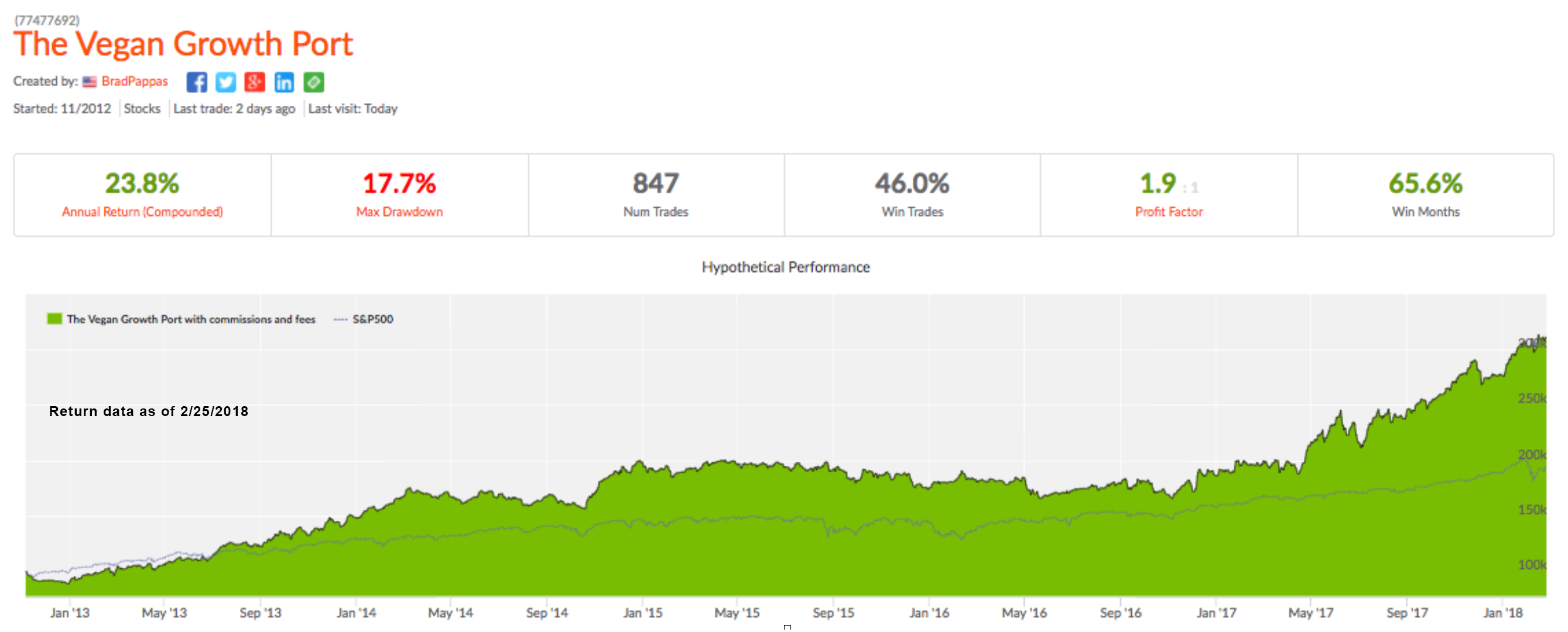

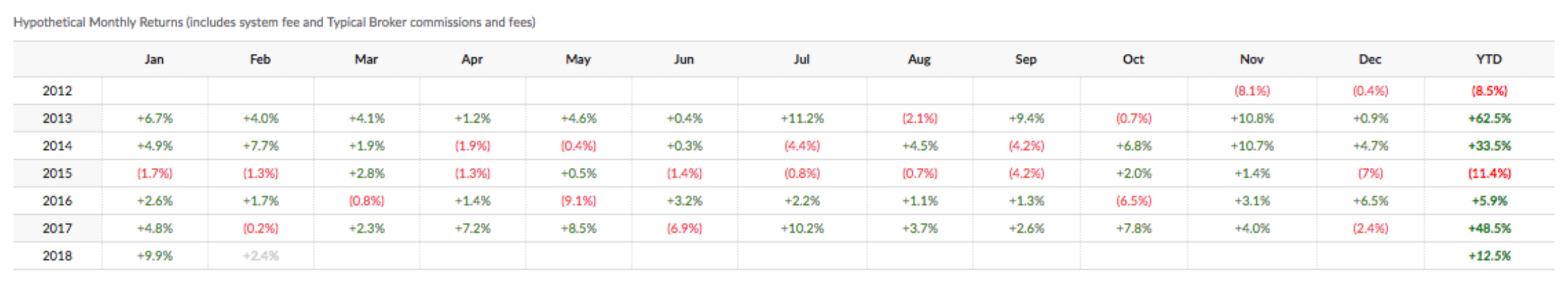

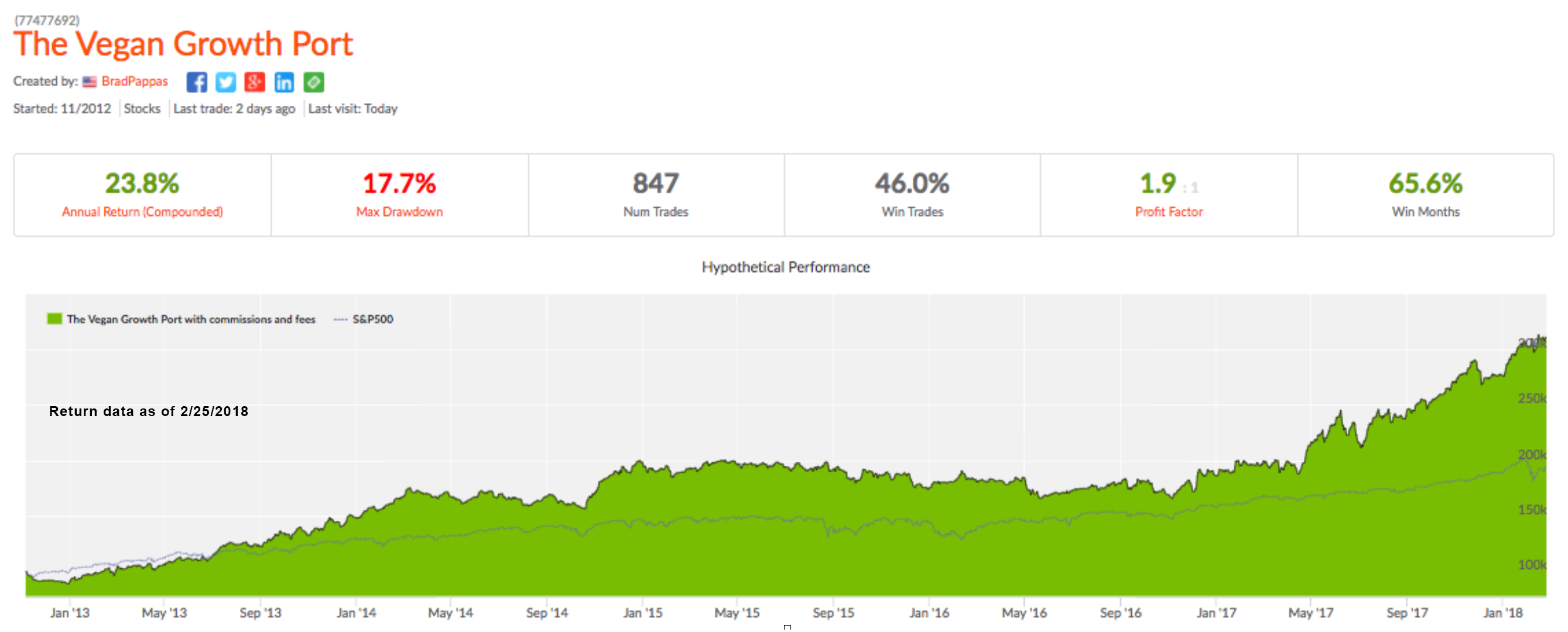

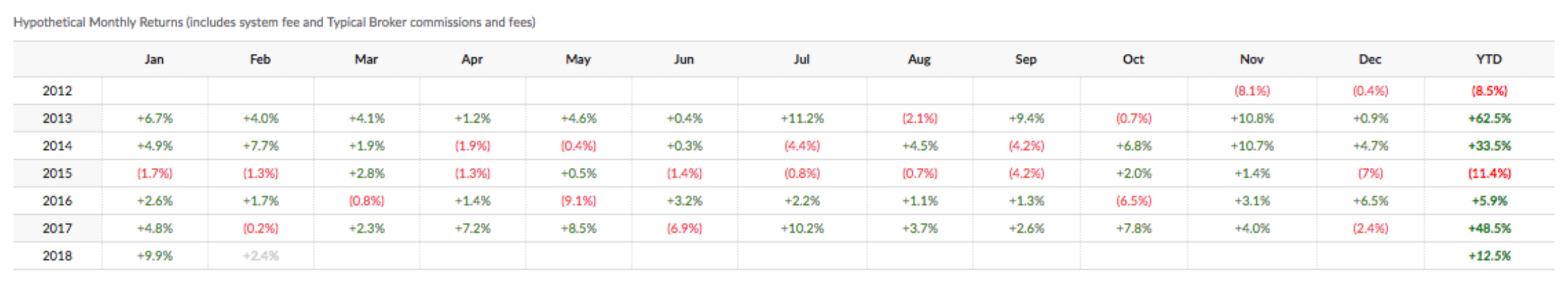

Client portfolios held their value and the Vegan Growth Portfolio model shows a positive gain for the year of 12.5% (net of all fees and expenses) versus 1.5% for the S&P 500.

A good advisor or investment manager should be paying attention to the many moving parts that could affect their client portfolios. In this instance, we were able to successfully anticipate the sell-off. That won’t always be the case and sometimes we’ll be wrong as well. I think it’s critically important for the long term success of our clients to act when we think the odds are good that we’re entering a high risk period.

Cheers,

Brad Pappas

President, RMHI

Brad@greeninvestment.com

970-222-2592

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.

Enjoy The Ride!

10/19/2017

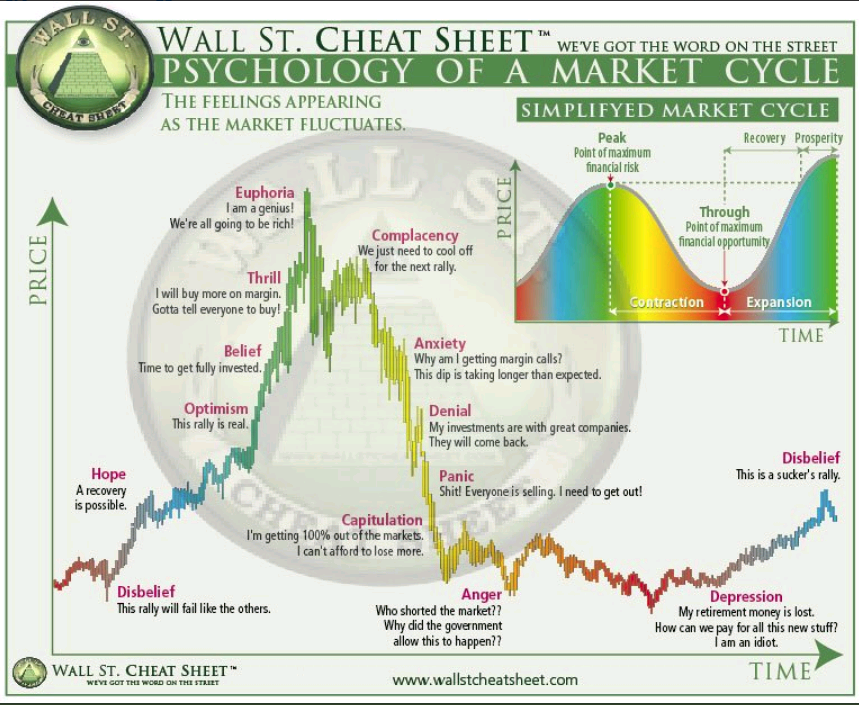

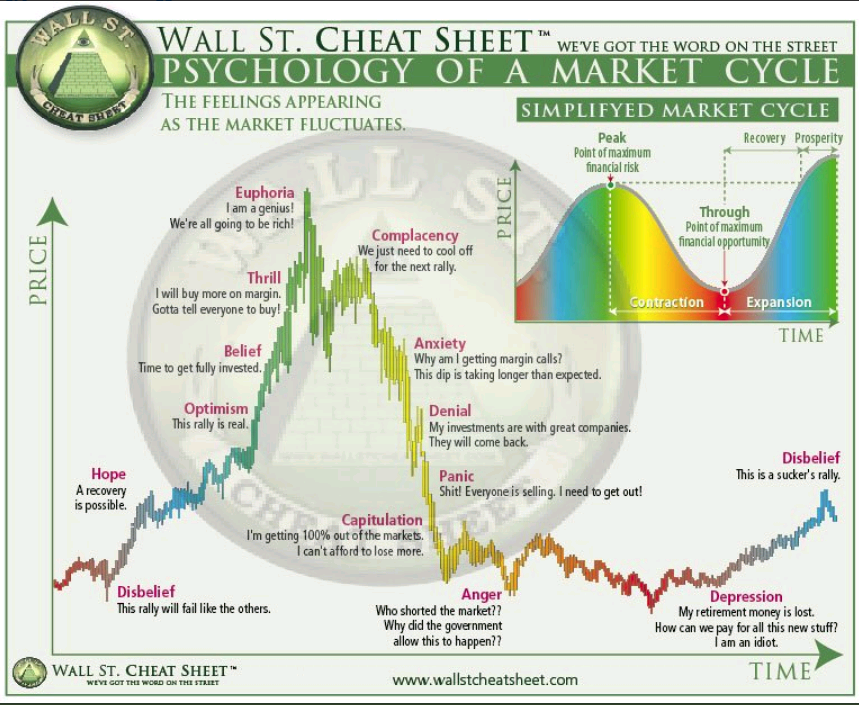

Since the market bottom last November the S&P 500 has rallied from 2083 to 2560, a very healthy gain of 22.8% not including dividends. Despite these gains there are almost no signs of euphoria within the investing community which leads me to think this rally still has a long way to go. Euphoria is a necessary evil that’s almost always seen at major market highs when investors refuse to believe the market will roll over.

Is there a valid case to be Bearish? Yes, but market momentum always takes precedence. Eventually the bears will be right but it may take a few more years and in the meantime so much opportunity will be lost. The bearish arguments have been around for years and completely dismissed as markets make new The bear case always sounds intelligent and well thought out but their losses and opportunities missed can be staggering.

This week marks the 17th time in the past 90 years that stocks made new all-time highs each day of the week. In only ONE instance did this ever mark the exact top of the stock market (1968). Higher highs occurred 94% of the time.

Once a trend has been established it tends to persist and run its full course.

Investing always has some form of anxiety for investors to contend with. If it’s not nervousness with the decline in your account value it’s the fear of the value rising too much and worrying you’ll give it all back. Is there a Goldilocks too hot – too cold – just right equivalence? Nope, but keep things simple as in try to sensibly grow your principal as much as possible in the good years and lose as little as possible in the bad. And, try not to mess it up in the meantime which is why: Temperament can more important than intellect.

In past years bonds offered a decent yield which allowed an investor to gain some income and diversify from stocks. The problem in this era is that yields are very low and in order to gain a modest, even a high single digit return there must be some increase in bond prices and very little of that is happening now.

One of the best books ever written on investing was authored by Jesse Livermore “How to trade in stocks” published in 1940. At his peak Livermore was worth an estimated $100 million in 1929 dollars after starting from scratch. His approach was systematic and still effective today and I use many of the rules he originally created for himself.

One of Livermore’s lessons was: “Money is made by SITTING not trading” To paraphrase, when you know you’re in the right you stay invested until the rally fades. You should remain in the stocks that are trending higher and take small losses along the way (never ride a losing stock down hoping it will turn).

The majority of “easy” money made in stocks is made during two unique phases of the economy/markets: The violent rally higher during the transition from recession to expansion and during long trending rallies in the mid cycle of the expansion like we’re experiencing right now. Smooth trending markets may happen just once or twice in a decade so it’s important to maximize the opportunity when it’s present.

While it’s part of our management philosophy to protect our clients during major down drafts, we do not sell prematurely or pretend that we can call a market top. “Top Calling” the stock market is a way of gaining media exposure and attention. Top Calling has nothing to do with solid investment management since astute advisors know it can’t be done. The better option is to let the market take us out when the time is right with our built in exposure systems.

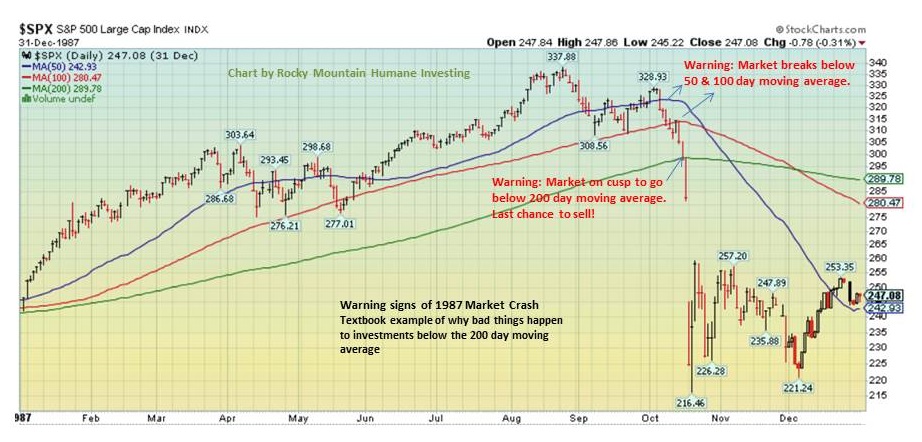

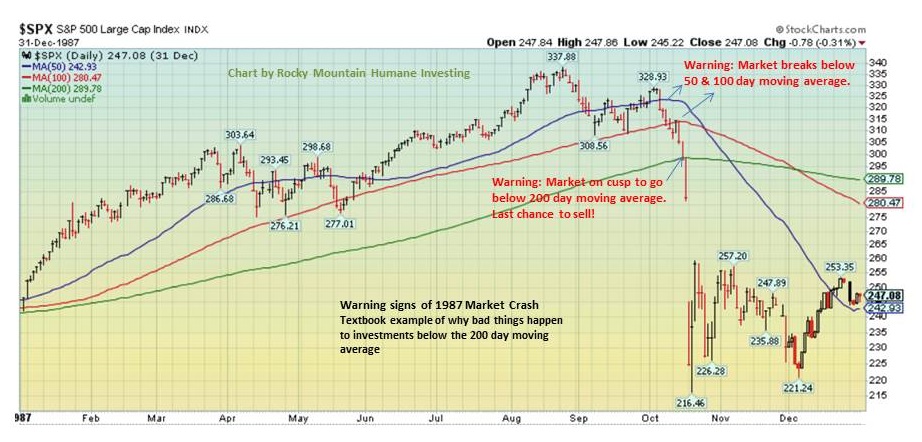

Charting the warning signs of the 1987 crash

It’s been 30 years since the 1987 crash so why not look at it closely for lessons?

The evolution of market tops is a gradual process whereby markets weaken as selling and distribution increase. Sometimes the flat sideways trend is nothing more than the “pause that refreshes” before another up-leg commences. However, sideways/choppy trends can also be the early stage of something more ominous.

In the summer of ‘87, the bond market was very weak with declining prices and higher yields which were becoming increasingly more attractive to stocks. This was causing a migration from stocks which began to manifest itself in August. These were the grand old days when investors wouldn’t buy a municipal bond unless it had a tax free yield of 10% or more.

Stocks peaked in August then sold off by 8% in September then rallied 6% into October before crashing. The decline in early October breached the 50-100-200 day moving averages which would have triggered a wave of sell signals for us. We always use the 200 day moving average as the ultimate cut off for owning stocks. I consider declines below the 200 day to be Bear Market country.

Summary: Enjoy the ride.

Brad Pappas

970-222-2592

Brad@greeninvestment.com

The information provided here is for general informational purposes only and should not be considered an individualized recommendation or personalized investment advice. The investment strategies mentioned here may not be suitable for everyone. Each investor needs to review an investment strategy for his or her own particular situation before making any investment decision. All expressions of opinion are subject to change without notice in reaction to shifting market, economic or political conditions. Data contained herein from third party providers is obtained from what are considered reliable sources. However, its accuracy, completeness or reliability cannot be guaranteed. Past performance is no guarantee of future results.

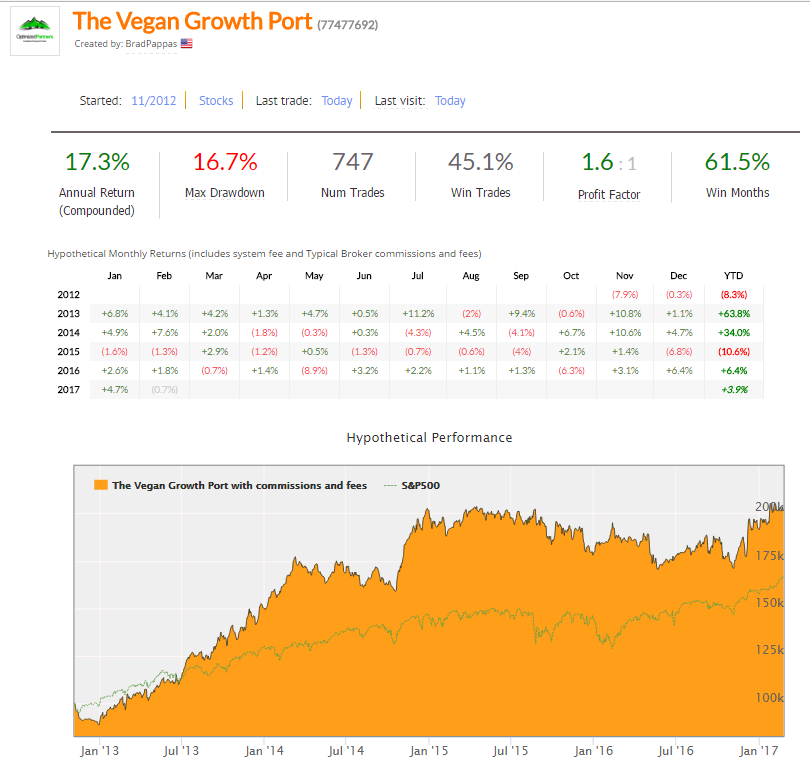

I should get around to doing this more often as we are in the minority when it comes to investment advisors willing to post portfolios and returns. I’ve advocated for years that retail investors don’t have to settle for the returns offered by indexers and robo-advisory firms. Robo’s are cheap but you won’t receive what we offer in terms of returns and bear market protection.

The Vegan Growth Portfolio is a name we use to describe the concept of investing with Vegan perspective. Its a diversified portfolio that usually has about 30 holdings when fully invested. When our indicators tell us that when stock market risk in unacceptable due to the potential for recession we reduce our stock holding and focus on Treasury bonds or cash.

Collective2.com offers a unique opportunity to create a mirror portfolio of our client holdings in the Vegan Growth Portfolio. In other words, the same day we buy or sell a stock for our clients we also buy or sell it in the VGP. The price may differ by a small amount but the Vegan Growth Portfolio shown on Collective2.com is close approximation to our client accounts.

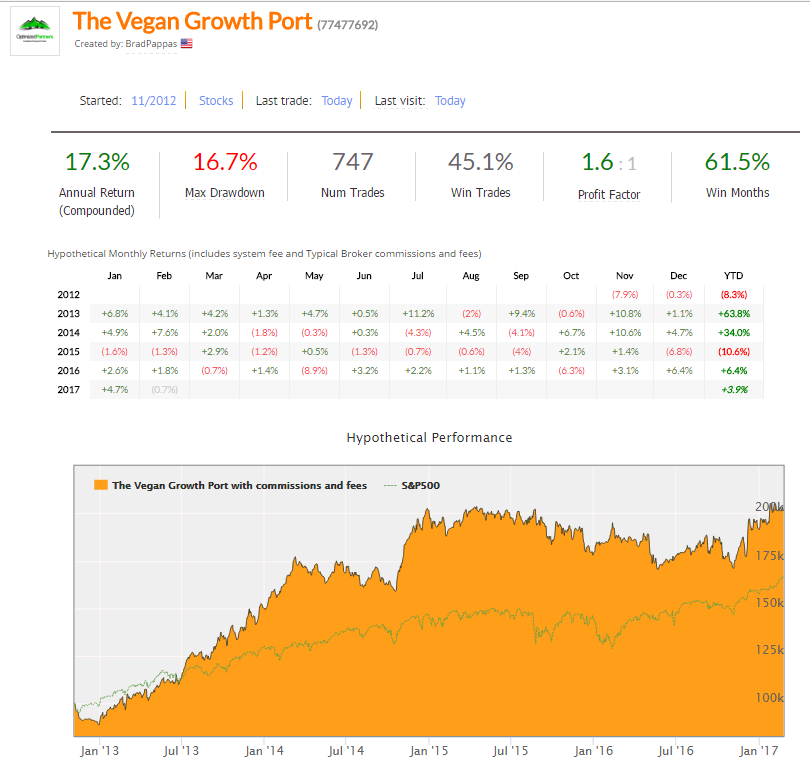

As you can see we are soon arriving to the important 5-year return milestone. As of 2/24/2017 the compounded annualized rate of return is 17.3% which is net of all fees and expenses. The gross (before fees) return is 18.8% per annum.

We respectfully ask when a potential client’s first question revolves around fee’s is which would you prefer: Make 4%-6% net at a indexer or robo-advisor like Betterment or our returns which charge more?

This example assumes and account size of at least $100,000. And, as we always have to say past performance is no guarantee of future performance. VGP is only suitable for investors who appropriately seek growth.

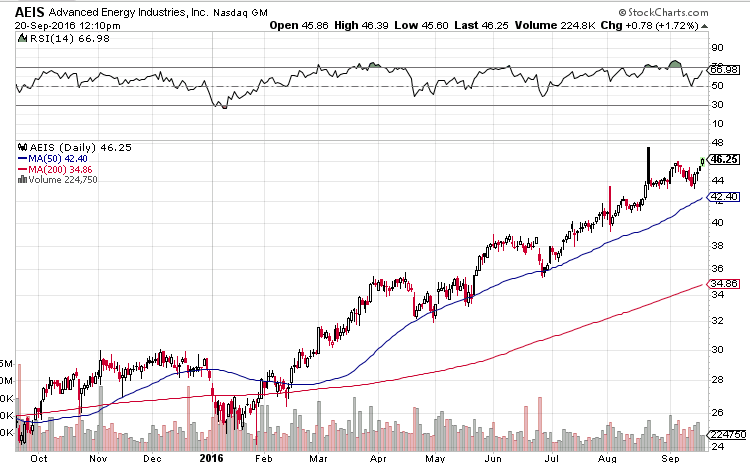

At present we have 35% of client assets in cash as the markets have receded from a high risk level. The late September/early October time period is notorious for steep market weakness. Should we witness a further pullback in the indices we’d have a low risk entry point to use our sidelined cash.

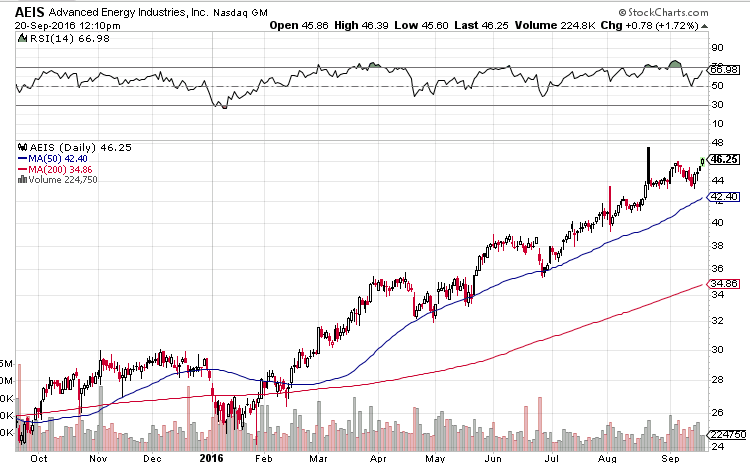

In the meantime a Green energy related company Advanced Energy Industries is behaving extremely well. We have only a small holding in The Vegan Growth Portfolio but would like to add more on any market pullback. AEIS is completely ignoring any market weakness as demand for the shares is very strong.

Long AEIS

Every once in a great while I’ll hear a song that will stop me in my tracks no matter what I’m doing, as time goes on that seems to becoming a rarer event but last night it was: Gnarls Barkley with “Who’s going to save my soul”. It could have been Motown back in the day but the slight hip-hop melody makes it a stunner.

One of the most common requests we receive from new investors is the Vegan investment portfolio. For more then two decades Socially Responsible Investing revolved around broad themes such as environmental and military issues. In the early 1990’s we introduced the concept of Humane Investing or avoiding companies with operations harmful to animals such as factory farming.

But now a new trend is emerging that we’re happy and capable of accommodating: The Vegan Investment Portfolio.

The Vegan Portfolio is built upon our standard humane investing concepts but with a closer and more discerning eye for details of a companies operations. While many investors employing socially responsible investing strategies may include owning Whole Foods Market or Chipotle Mexican Grill the Vegan criteria excludes such ownership. But in our experience its also not accurate to assume that the Vegan portfolio must exclude consumer staple or food stocks. In the past year we’ve owned stocks such as J. B. Sanfillippo and Sons symbol JBSS (nuts) or Calavo Growers symbol CVGW (avocados).

We like to think that owning individual securities with our proprietary quantitative investment strategies offers investors a very strong alternative to mutual funds. Investors must keep in mind some basics of mutual fund practices:

By our calculations mutual funds that classify themselves as “Large Cap” only have approximately 500 stocks to choose from.

Mid Cap mutual funds have approximately 840 stocks to choose from.

Once you consider that a Vegan screen combined with other social screens could eliminate at least 30% of the universe of stocks to choose from the remaining investment choices can be quite limited. If you’re a Large Cap fund that could mean less than 350 stocks to choose from which is a major reason why applying social screens to Large Cap mutual funds are quite difficult to implement and why you can be quite surprised when you see the contents of an SRI fund.

RMHI has the entire U.S. equity universe to choose from or approximately 6800 stocks which is quite an advantage. In addition, we can avoid the large multinationals that have hands in many businesses and focus on companies that are specific in their business operations which gives us confidence that their practices meet our social screening standards.

Since our universe of selection is relatively large compared to mid cap and large cap funds the implementation of a Vegan criteria is much easier to implement.

A Vegan criteria screen eliminates the following, but not limited to:

Factory Farming including all producers of non vegetarian foods.

Leather / Hunting retailers – including shoe retailers such as Brown Shoes or Cabellas.

Firearms manufacturers.

Animal Testing companies which includes biotechnology and pharmaceutical manufacturers.

Restaurants including fast food restaurants.

Specialty chemical companies that create compounds that could be used in support of other offending companies.

Extractive industries such as mining, gold, petroleum and needless to say fracking.

I’m sure there are other classes of companies to be excluded and we will usually address them as they come to the top of our rankings systems. But have no fear if you might think the list above is too restrictive, our 30 stock portfolio on Collective2.com is by most definitions a Vegan portfolio.

There are always companies that fall into gray areas where there is no right choice except the choice most comfortable to the investor. A recent example is Big 5 sporting goods which sell items like baseballs, baseball gloves and footballs all made with leather.

To summarize, while many non SRI investment planners and advisors may have little idea what a Vegan portfolio looks like they are always welcome at RMHI. In addition the realities of owning and managing large and mid sized mutual funds can make social screening impractical due to the limited size of the stock selection universe. This can be avoided by including smaller sized companies (under $500 million capitalization) .

RMHI owns no positions mentioned.