RMHI Client Letter, December 2025

“If you wait till you have all the information the battle is lost”

Admiral Raymond Spruance at the battle of Midway.

Stock valuations are higher than ever before including 1929, 2000 and 2007. Assuming an investor buys and holds an S&P 500 index fund when the stock market was valued at 23x earnings, the 10-year average rate of return range falls to +2% to -2%. However when US stocks are selling at 25x earnings the 10- year return was negative.

When market valuations eventually revert (as they always do) lower, the losses will be huge and life altering.

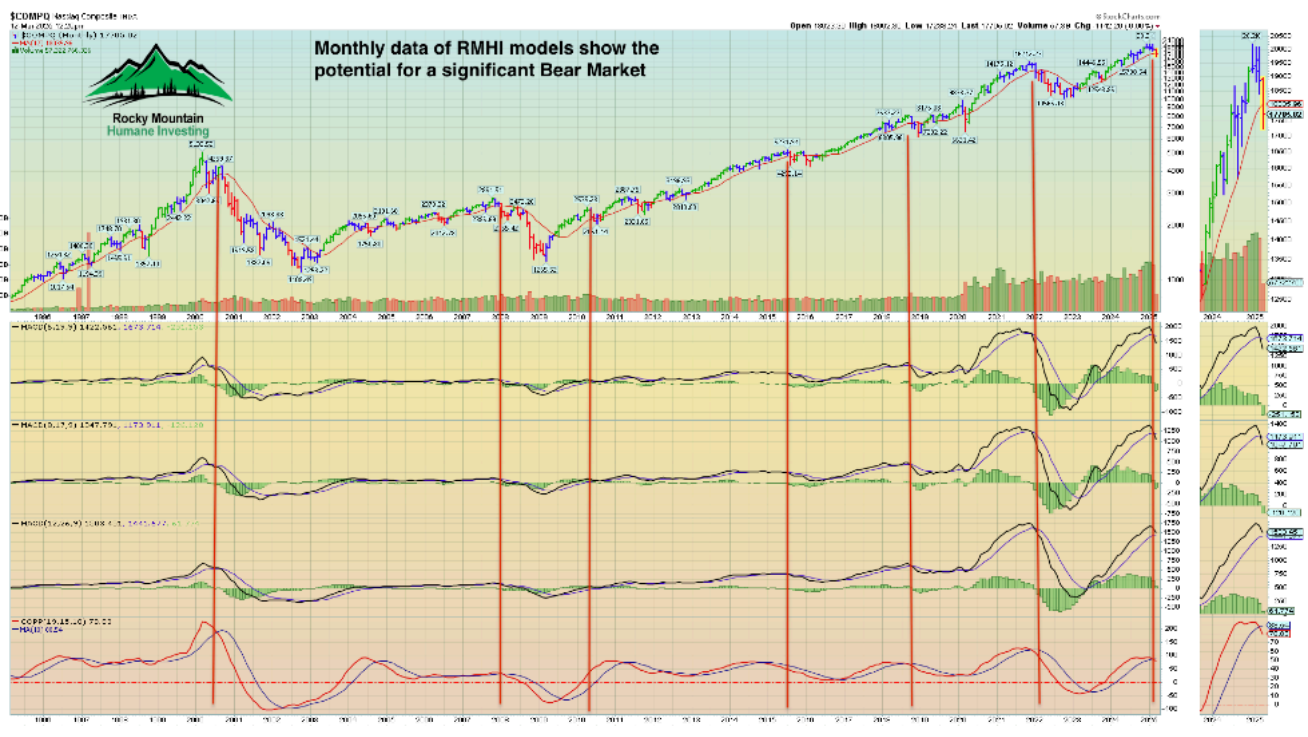

RMHI does not blindly believe in buy and hold, especially when markets are at extreme valuations.

My expectation is that over the next 10 years there will be several significant declines and several rallies. In other words a choppy decade for stocks.

This is the reason why there has been above average activity in client accounts as I’ve reduced stock market risk.

The peak last month looks deceptive as it was not a reflection of the average stock making new highs aka “Rising tide raises all boats”. It was based on the strategy of “Invest in AI or go home”. Meaning that the momentum of AI related stocks was alone in propelling the market higher.

If an investor was of the opinion that AI has such a long way to go and to sell now is foolish. That investor may be right but history is replete with mass hysteria of believing “trees will grow to the sky”.

On October 15, 1929 Yale’s Irving Fisher infamous claim: “Stock prices have what looks like a permanently high plateau”. Just 9 days later on October 24, 1929 was “Black Thursday” when the stock market lost 11% of its value on the opening bell with further losses in the weeks following.

In recent times “We see no indications in the marketplace that the radical internet business transformation…is slowing – in fact we believe it is accelerating globally.” John Chambers Cisco Systems CEO August 2000. “…we experienced parts shortages because of industrywide capacity constraints and unprecedented demand for our communications products.” Agilent CEO November 2000.

“Based on momentum we have experienced during the first nine months and the strong order backlog , we continued to expect that our growth in 2000 over 1999 will be in the low 40%’s.”

Nortel October 2000 press release Nortel filed for bankruptcy January 2009.

Agilent didn’t go out of business but sold its original electronics business.

Cisco Systems exists today. Cisco’s stock price peaked at $53 in 2000 and fell to $5 in 2002. It did regain its 2000 market price once again…..in 2021.

“Blackwell sales are off the charts, and cloud GPUs are sold out”. “We entered the virtuous cycle of AI. The AI ecosystem is scaling fast”. Nvidia CEO November 2025.

A reminder that former tech leaders usually don’t see the cliff ahead.

All the quotes above are Bubble-Speak. These quotes only speak of demand for products and do not reflect the profitability of the end users. If the end users profitability is as poor as current estimates are pointing then the manufacturers will face price competition since demand will be reduced and eventually less expensive providers will come to the forefront. All the while AI could continue to be of great service.

These Bubble cycles eventually do pop and the history of these cycles goes back hundreds of years.

It remains to be seen what will happen to AI investments going forward but such effusive language should generate concern and caution for those old enough to have been around in 2000.

Consider insider selling at Nvidia: in the past six months there have been 527 sales by insiders totaling $1,906,942,689. Source: Dataroma

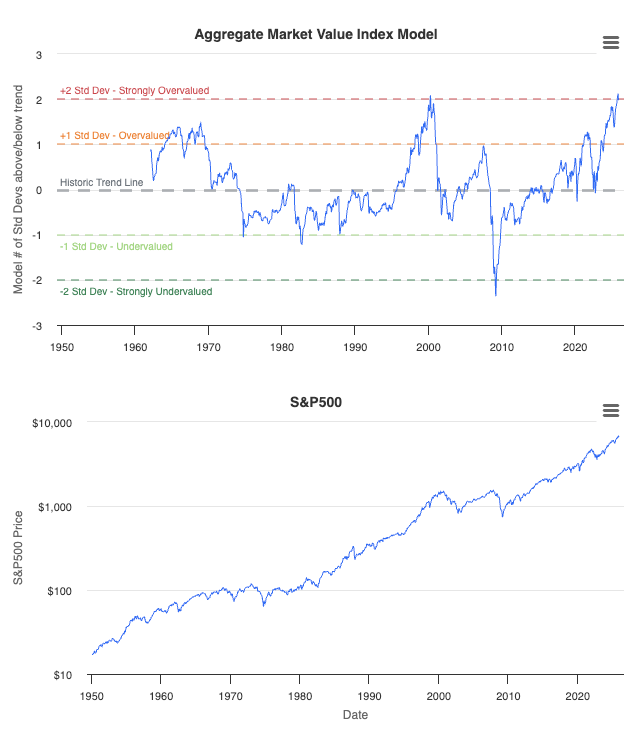

Below is the Aggregate Market Value Index from Currentmarketvaluation.com. It’s a composite of several valuation methods which show a correlation to future returns.

It states we are two standard deviations above historical valuation norms. It’s not a short term timing model but provides a macro perspective on risk/reward. There has never an era where such an extended market valuation produced positive forward returns for extended periods of time.

At times like this, minimal or risk free returns on Treasury bonds or high quality bonds become a better alternative for extended time periods. As the old bromide goes: “better a modest return on capital than the risk of capital returned.”

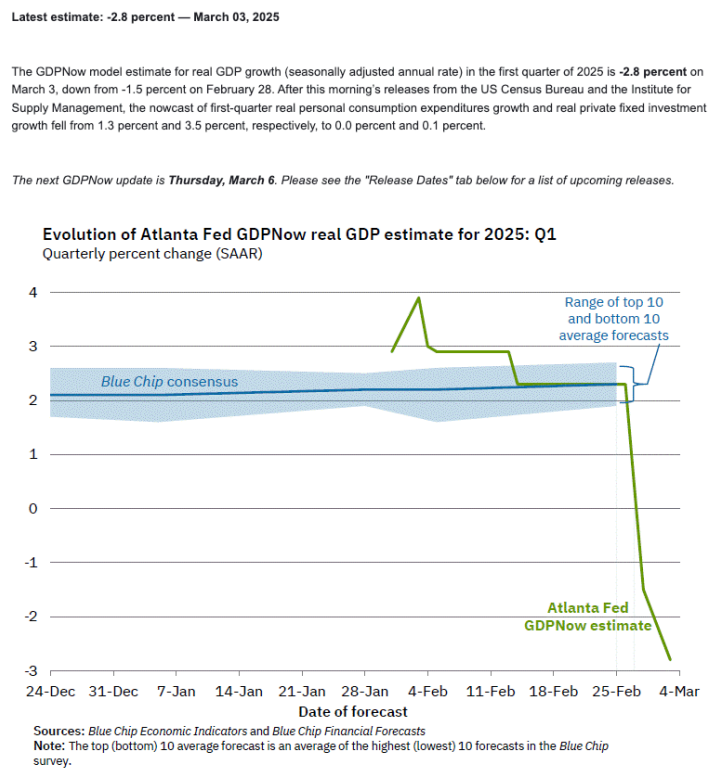

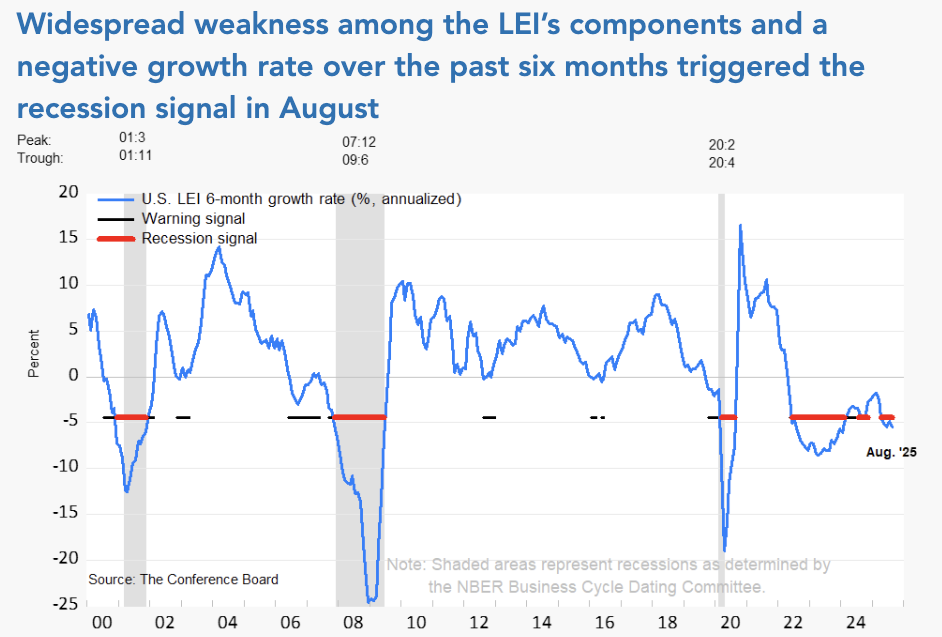

What else is concerned about? The slowing economy and growing unemployment.

Recessions are difficult to predict but we are heading that way. We’ve already reached the point where growing unemployment usually leads to recessions. But, AI infrastructure spending is close to 50% of GDP. Without AI spending we would likely already be in recession.*. AI may contributed to close to 50% of US GDP growth in the first half of 2025. Source: BCA Research

Kevin Hasset is the front runner to be the new head of the Federal Reserve and he has been vocal for aggressive interest rate cuts. In my opinion this may be the reason why stocks continue to move higher. And, aggressive rate cuts are likely positive for Gold.

The trend in unemployment growth is concerning. Because of the government shutdown October employment data will not be published.

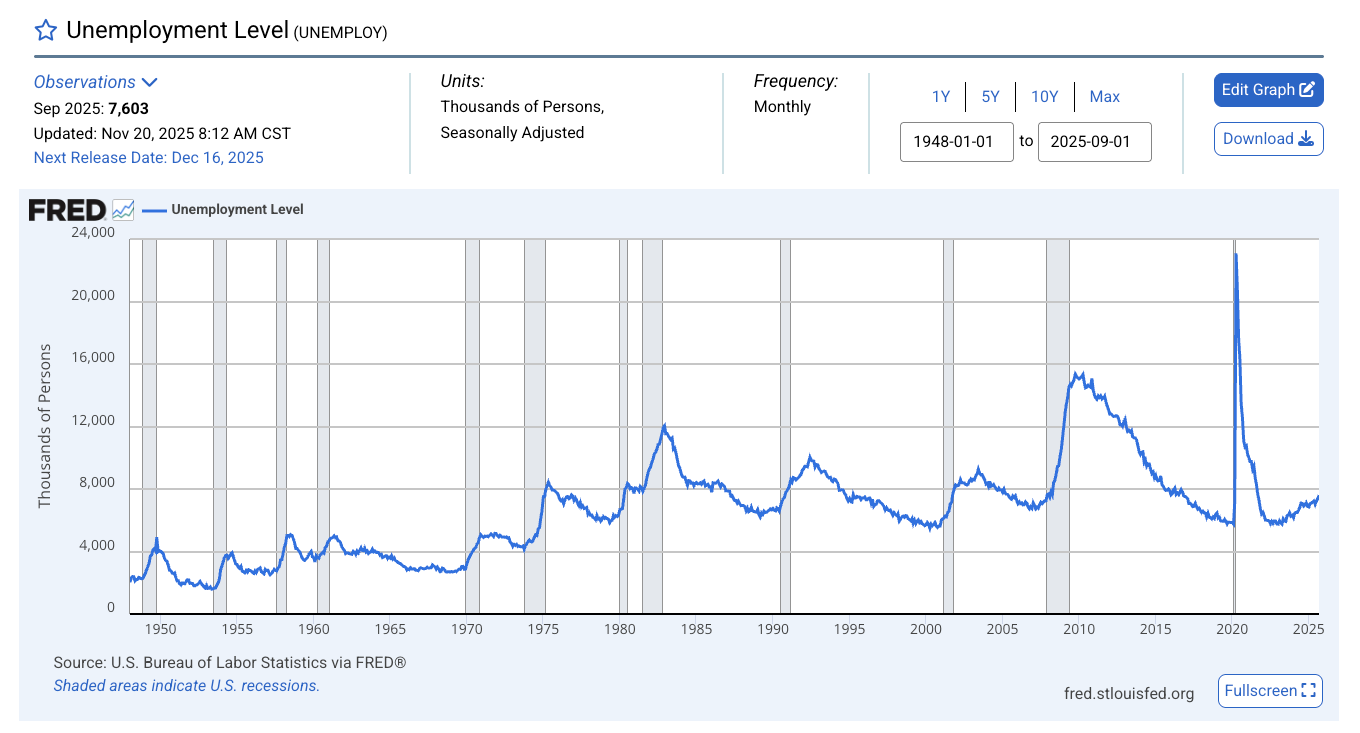

Below is the Unemployment data from the Federal Reserve. Notice the move higher on the far right of the chart that has historically evolved into a recession.

Since we are nearing the end of the tax year, taxes must be taken into consideration. Many of the recent trades were to capture tax losses to offset gains from earlier this year. Losses are taken in both taxable and unaffected non taxable accounts at the same time.

Shares of Applovin, Robinhood, O’Reilly Auto were taken in whole. Partial gains were taken in some of the more volatile names such as Arista, Amphenol, Broadcom, Celestica, Comfort Systems, Interdigital and Sterling. All of these stocks have AI exposure and are likely overvalued but they continue to power higher.

Since stocks are quite overvalued I have cut our exposure and have been seeking high quality bonds and treasuries.

Recently I added a 5-year Treasury to portfolios with a yield of 3.48% but I’m also looking for safe yields higher than what Treasuries offer.

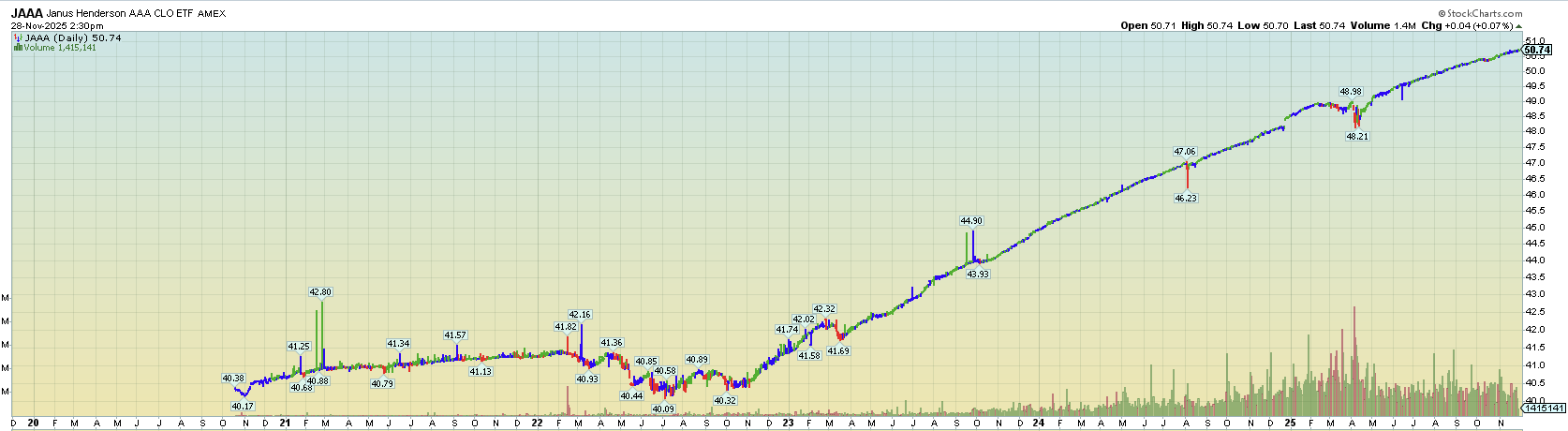

Adding Janus Henderson AAA CLO ETF Symbol JAAA: This is a AAA rated (the US is AA rated) Collateralized Loan Obligations.

This Exchange Traded Fund is a very conservative alternative to Treasuries. It pays a present yield of 5.49%.

The fund buys the highest rated loans which are “floating rate”. Floating Rate means the interest rate on the loan will change according to the direction of interest rates. This prevents the ETF from losing value should interest rates rise. Since its of the highest rating possible with low downgrade or interest rate risk its a worthy alternative to Treasuries.

The chart above shows the trading history of JAAA. Note that in the market weakness of 2020 the fund sold off by about 5% at its worst. This can be due to several factors unrelated to the fund. Most of the time its from funds needing to raise cash. These periodic weak periods are excellent buying opportunities.

Adding Janus Henderson Securitized Income ETF symbol JSI: It invests in very high rated securitized bonds. They primarily own bonds from Fannie Mae aka Federal National Mortgage Association. Current yield is 5.79%.

Following The Money

Money tends to flow to assets that offer better reward potential. The decline of the US dollar is causing funds to leave the U.S. in search of better opportunities.

According to Seabreeze Partners AI investing represents 42% of the S&P 500 index. So if the AI trade is showing signs of fraying the volatility could become severe in the U.S..

Under the radar is the fact that Latin American stock markets are having a very good year propelled by the weak USD. Brazil in particular. In Latin America the valuations of their markets are at a fraction of the U.S. Brazil trades at 8x earnings compared to 25x for the U.S.

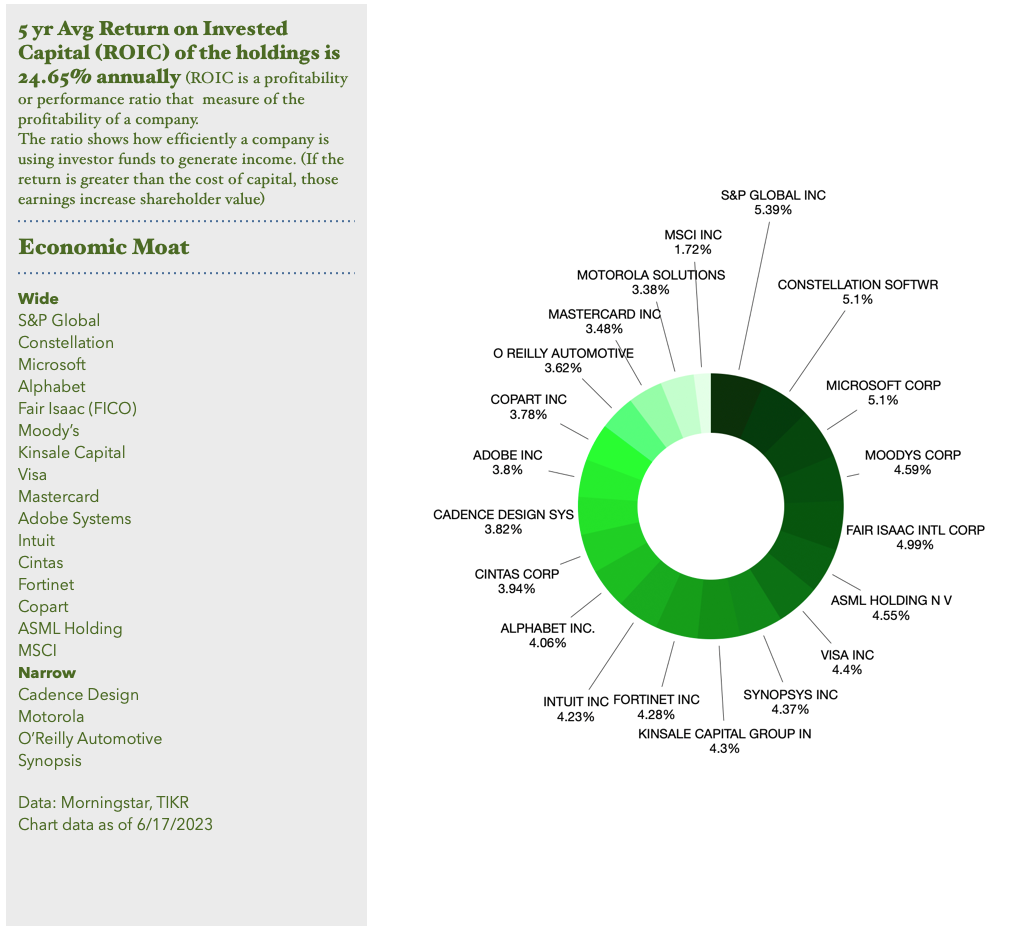

So I’ve added three essential stocks from Latin markets. And, back to Constellation Software which is Canadian.

By “essential” I mean non cyclical companies that provide basic services with reliable revenues and earnings.

America Movil symbol AMX: We’ve owned AMX before in the early 2000’s. They provide telecommunications services to Latin America and internationally.

Companhia De Saneamen symbol: SBS. SBS provides basic water and sanitation services in Brazil for the San Paolo state. Founded in 1954 and it has been a stellar performer for a very long time. I’ve followed them for years waiting for an opportunity which has now presented itself.

Nu Holdings symbol: NU, Nu provides a digital banking platform in Brazil, Mexico, Colombia, Cayman Islands and the U.S. Revenues for NU have been growing exponentially since they went public in 2018. NU became profitable in 2023 and has a stellar 27% return on capital.

Constellation Software symbol: CNSWF. Constellation has endured the deepest price pullback in its history. Shares peaked in May at $3996 and a bottom may be in place at $2235.

Reasons for the selloff were two fold: The quick resignation of founder and CEO Mark Leonard for health reasons. And, the theory that AI will transform software creation making Constellation irrelevant. Since the shares have declined by 52% and if a peak in AI investing is occurring shares of Constellation would rebound in 2026. If it falls to new lows I’ll sell.

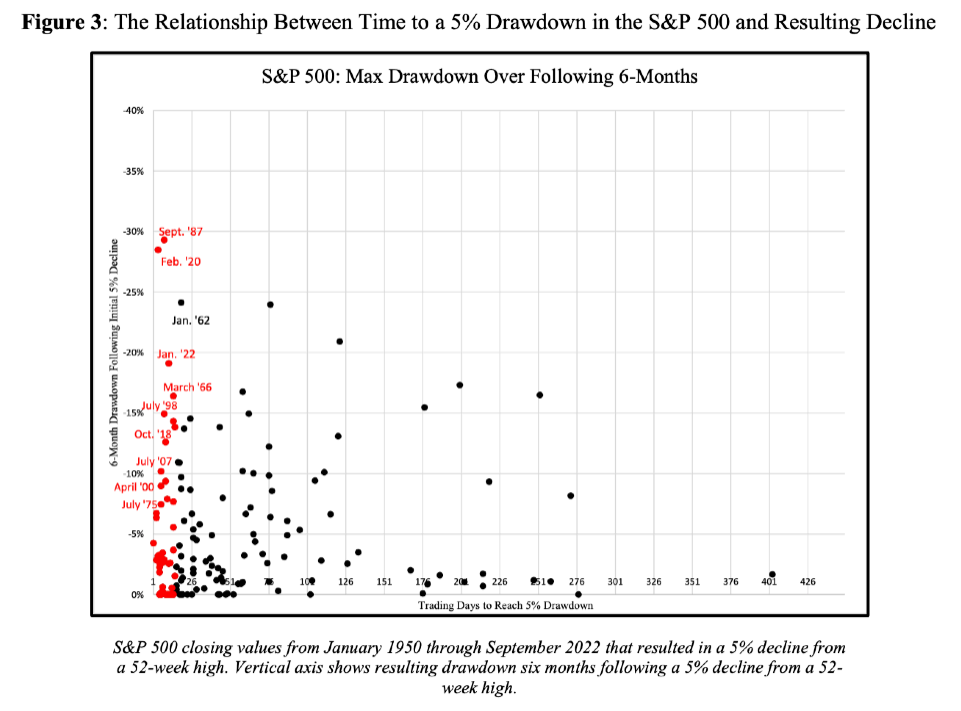

Quick Summary: I’m expecting U.S. stocks to revert back to normal valuations at some point. I think its a fools game to try to wait till the last minute because we never know when that minute is occurring.

Prolonged Bear Markets in U.S. stocks do have significant rallies to participate in as long as you kept your funds and psyche intact. In the 2000 Internet bubble an excellent and prolonged rally occurred from 2003 to 2007. Similar rallies occurred in the 1930’s and 1970’s.

My goal is to find the acceptable investments during what is likely to be a difficult future for stocks.

Gold and Silver, high quality international stocks plus safe Treasuries and other bond ETF’s are likely at the front of the list.

Thank you for reading.

Brad Pappas

12/3/25

Disclaimer: The purpose of this letter is solely for the dissemination of information investment products or services. Investment advice or the rendering of investment advice for compensation will not be made absent of compliance with the state investment advisor requirements. For information concerning the compliance status or disciplinary

history of advisor or firm the consumer should connate their state securities law administration.

The information contained in this letter and email should not be construed as a financial or investment advice for any subject matter. Rocky Mountain Humane Investing, Corp. expressly disclaims all liability in respect to actions taken based on or any of the information on this email.

As always, past performance is no guarantee of future success or returns. In fact future returns may be negative or unprofitable. Accounts managed by RMHI are not diversified. Meaning they own less companies than a diversified fund. Thus the portfolios may be more exposed to individual stock volatility than a diversified fund.