Waiting for the Fat Pitch

Waiting for the Fat Pitch

Feb 2023

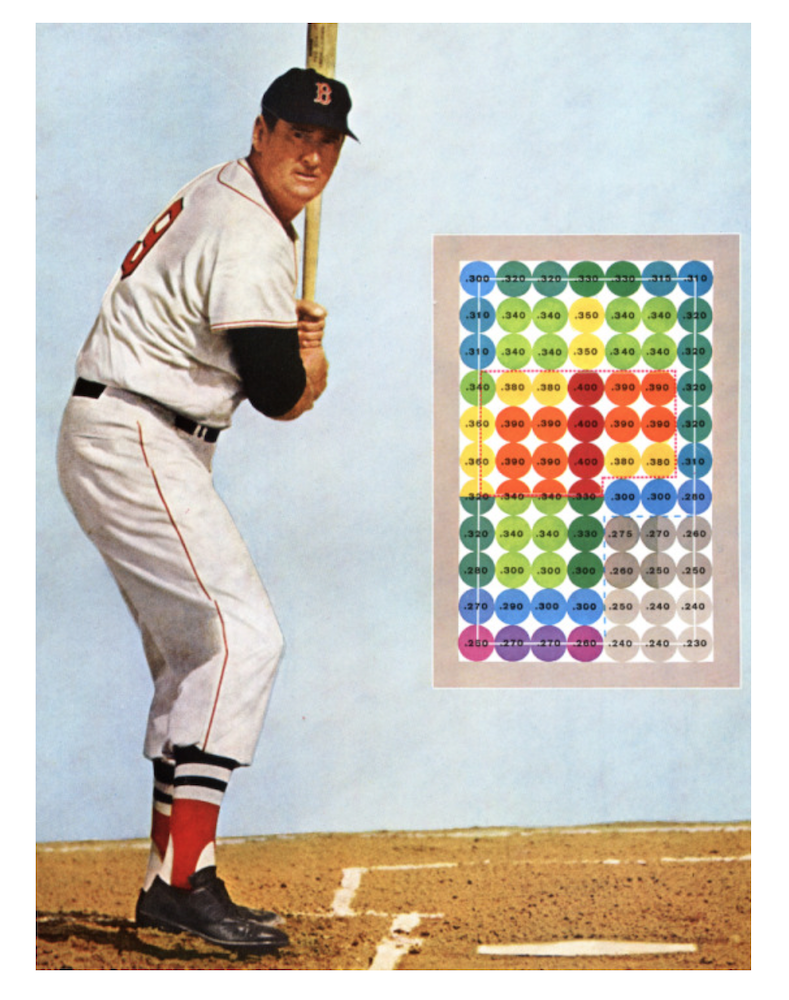

For those not familiar: The Fat Pitch is a baseball reference for when a pitcher leaves a pitch flat and over the center of the plate. Meaning, that a pitch in the red zone offers the highest success percentage for a base hit. A disciplined batter will avoid low odds pitches and wait for a pitch right over the plate. No one put this concept more succinctly than Ted Willams.

For Ted Williams, the orange and especially the red zones were his ideal sweet spot. A spot he rarely missed which is depicted by the batting average inside each circle. In a career if you hit over .300 (a base hit in 30% of your at-bats you might well be in the Hall of Fame. He hit .344 during his career and he is arguably the greatest hitter of all time.

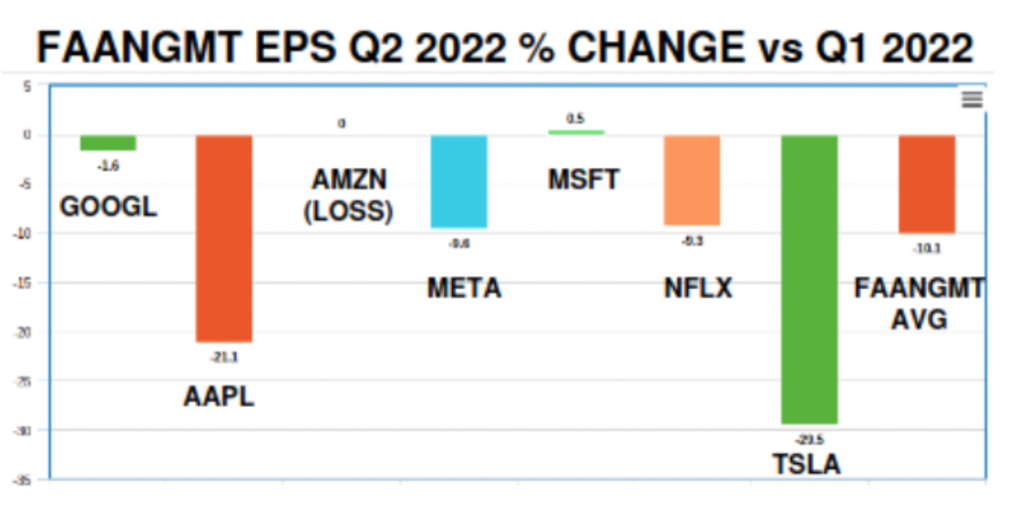

How does this apply to investing? I am waiting for the Fat Pitch aka the pitch in the red zone that has the highest probability of success. It’s expected there will be several tempting entry points for growth in 2023. My effort is to patient and wait for a pitch in the red zone.

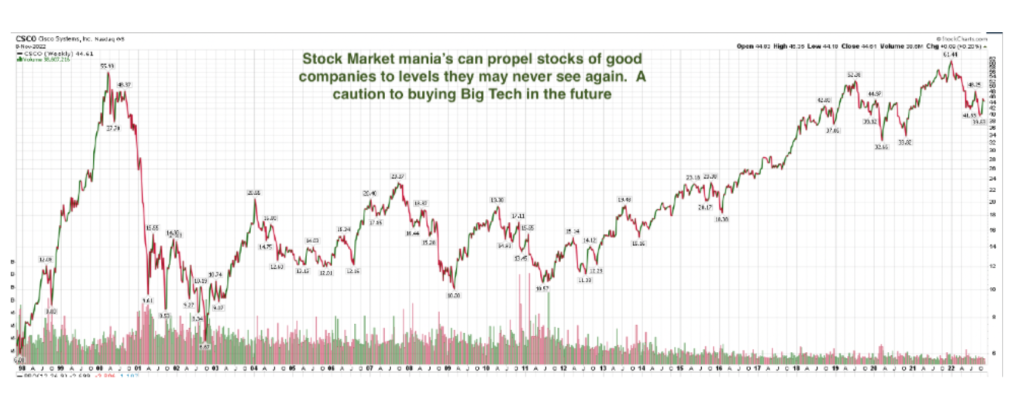

For example in the Dot Com bust of 2000 to 2003 the top 5 Bear market rallies in the S&P 500 of 24%, 19%,12%,12% and 11%. But the peak to trough drawdown during the same period was -49%.

In the Great Financial Crisis of 2007 to 2009 the top 5 rallies were 21%, 21%, 21%, 19% and 15%. The peak to trough drawdown during the same period was -56%.

Investors who chase these interim rallies are swinging at bad pitches with low success rates. Fear or FOMO (Fear of Missing Out) is an important driver for investors who think the markets can’t go lower and “This is the bottom”.

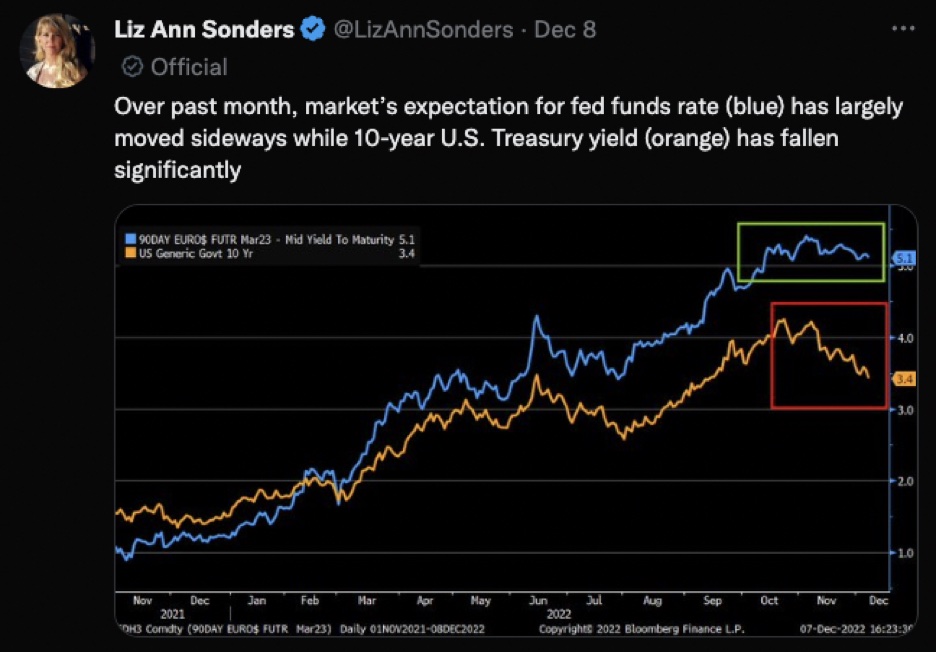

We remain in a Bear Market

How will we know we are transitioning from Bear to Bull Market or in the example above to Fat Pitches?

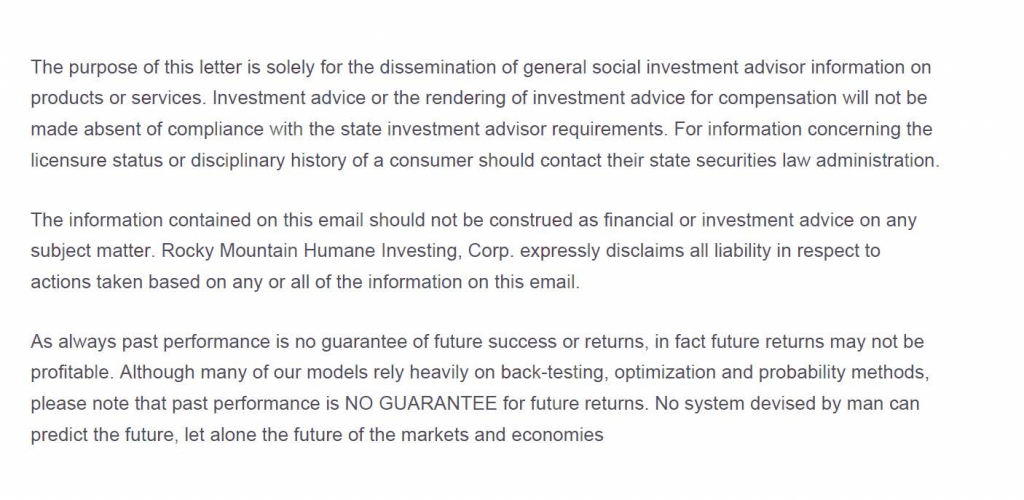

- A series of aggressive interest rate cuts by the Federal Reserve. Lower rates allow stocks be more relatively attractive. Hiking rates makes them less attractive.

- An obvious recession: No more debates as when, if or how bad will the recession be. It will be obvious especially when the unemployment rate rises.

- The yield on 9 month Treasury Bill 4.9% and the dividend yield on the S&P 500 1.7%. At present the gap is potentially serious. A recession with falling stock prices would increase the dividend rate for stocks. Plus, the Federal Reserve would lower the Fed Funds rate which would narrow the gap.

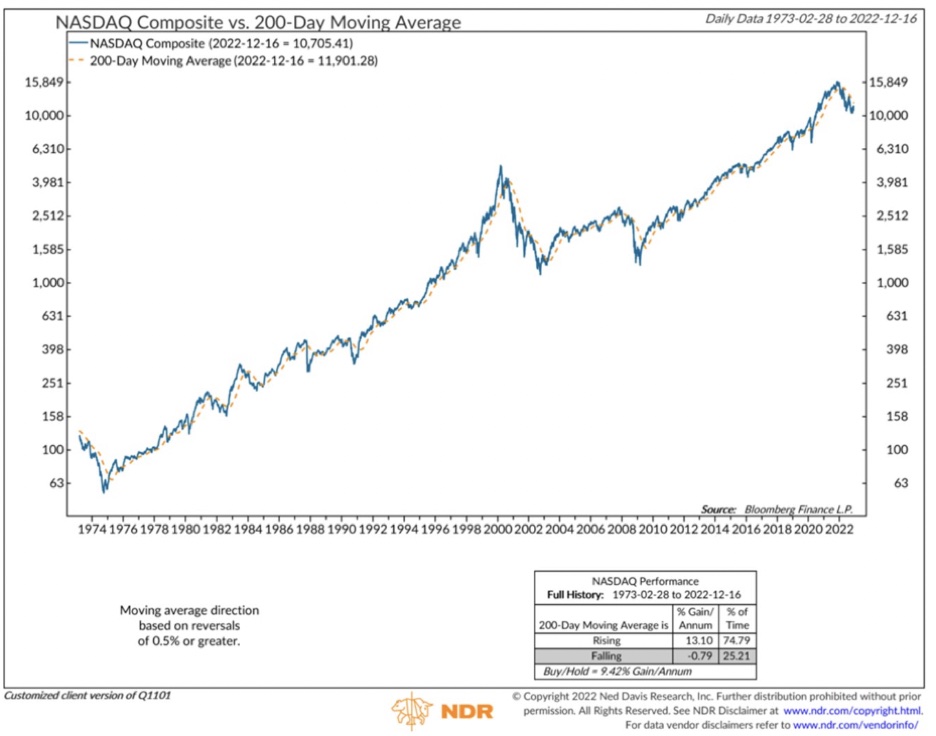

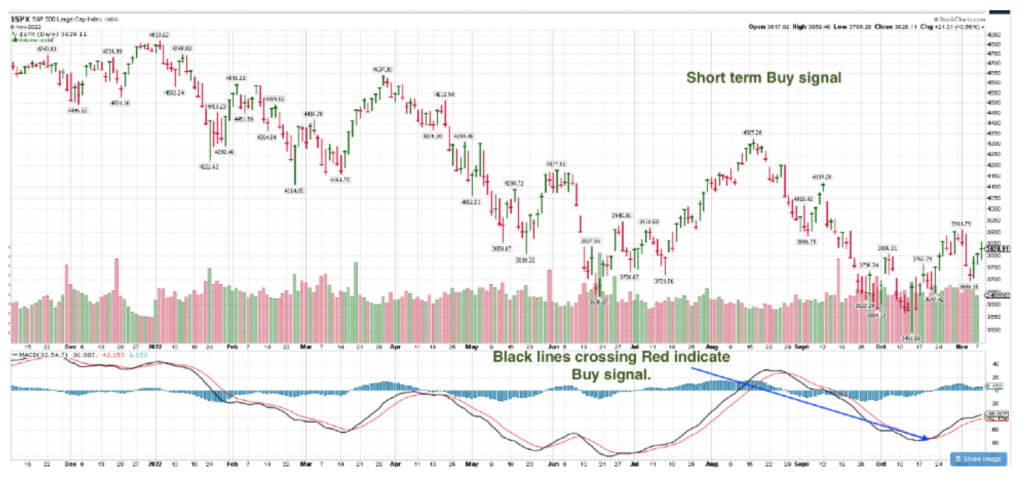

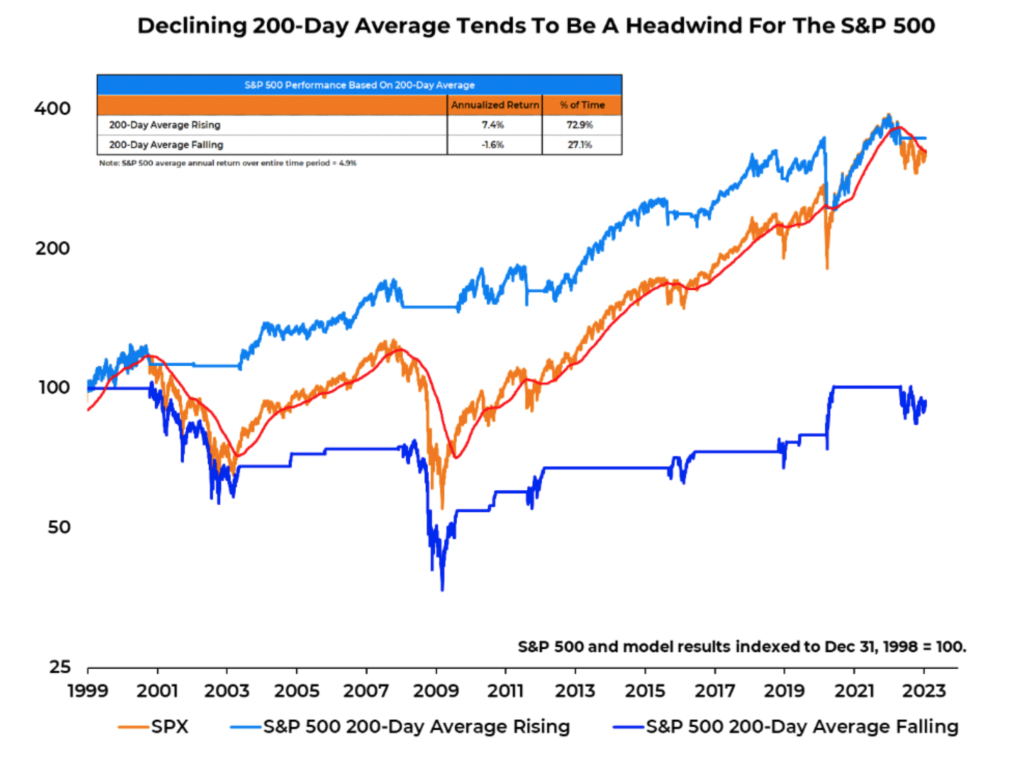

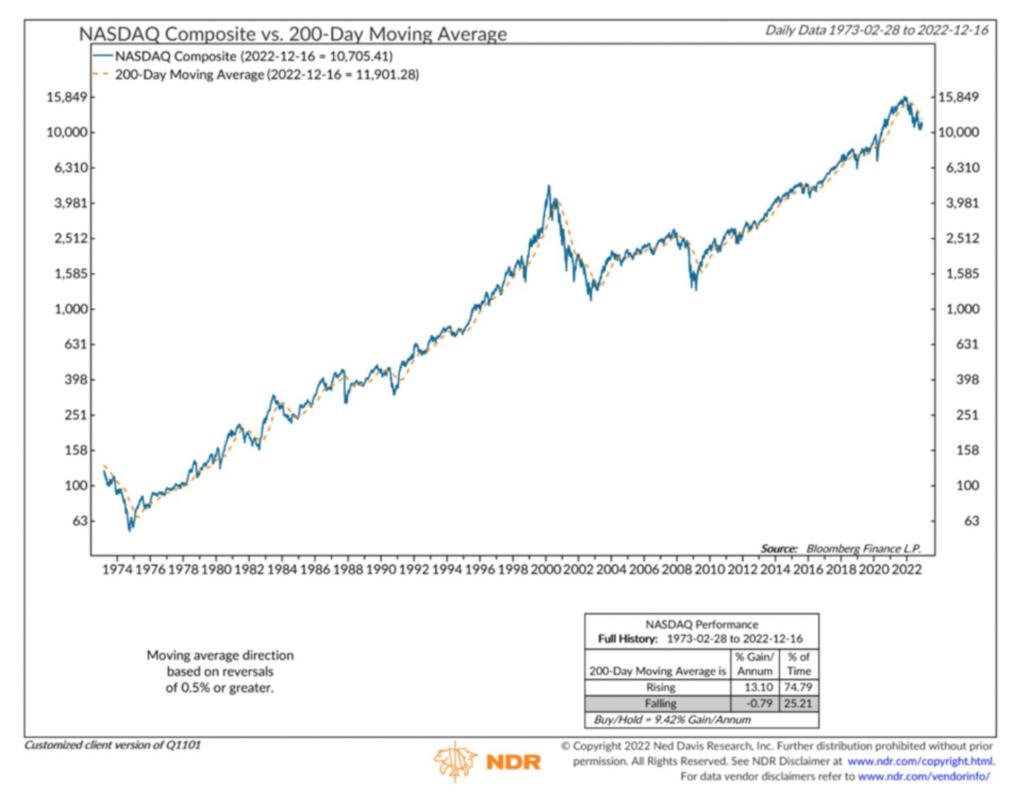

- Finally, the downward slope of the 200-day moving average of the S&P 500 and the NASDAQ reverses to the upside. If there is a single factor that could signal the end of the negative trend in prices it would be a new upward slope of the 200-day moving averages. See the two charts below. Upward and downward slopes have a contrasting binary outcome.

Upward slope = +7.4% annualized rate of return

Downward slope = -1.6% annualized rate of return

Nasdaq Composite

Upward Slope = 13.1% annualized rate of return

Downward Slope = 0.79% annualized rate of return

To further define what it means to be buying stocks in a downtrend. Buying into a downtrend forces the investor to be a trader rather than a long term investor. Estimates have shown that over 70% of a stock’s behavior is due to underlying trend of the stock market as a whole. So by my way of thinking buying stocks in a downtrends is swinging at bad pitches.

If I’m completely wrong in my summary there is an exception. All transitions from Bear market to Bull market are confirmed by a trend change in the 200-day moving average. The 200-dma moves into an uptrend by default if stocks continue to show strength long enough.

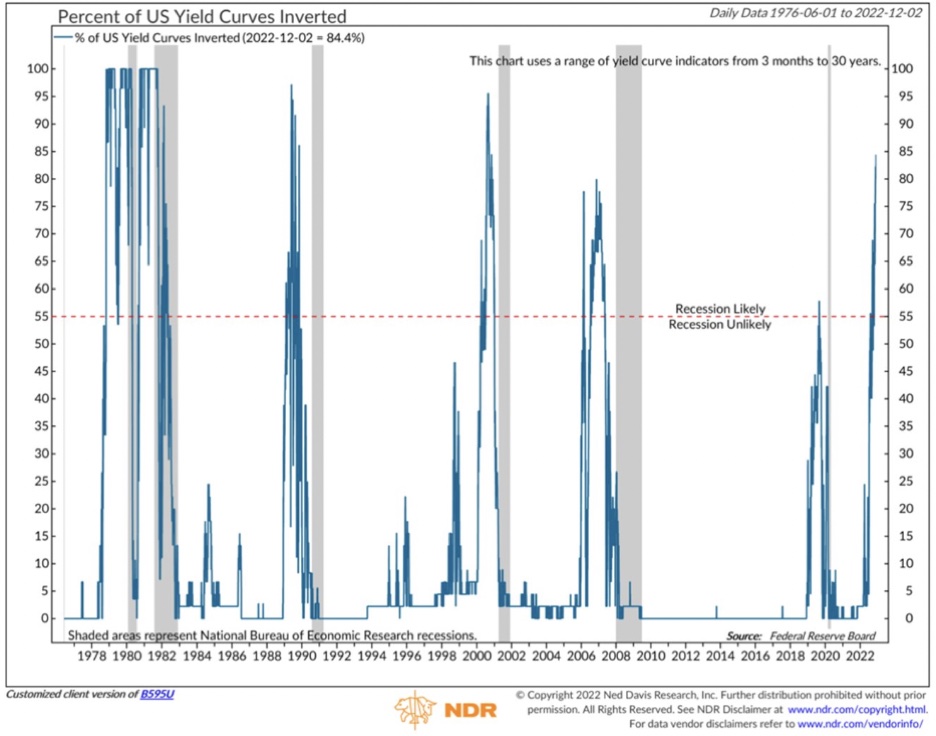

Recent market strength

Markets view Fed Chair Powell as weak. In other words, they don’t see Powell as having the will to drive inflation into the ground with rate hikes. He’s not former Fed Chair Paul Volker who pushed rates to 20% in March 1980.

Volker at 6’7 with billowing cigar smoke in congressional hearings was the Capo Di Tutti Capi of Fed Chairs. Not to be intimidated by anyone especially Congress. The result of his rate hikes was the recession of 1981. However, his efforts put an end to the inflation of the 1970’s.

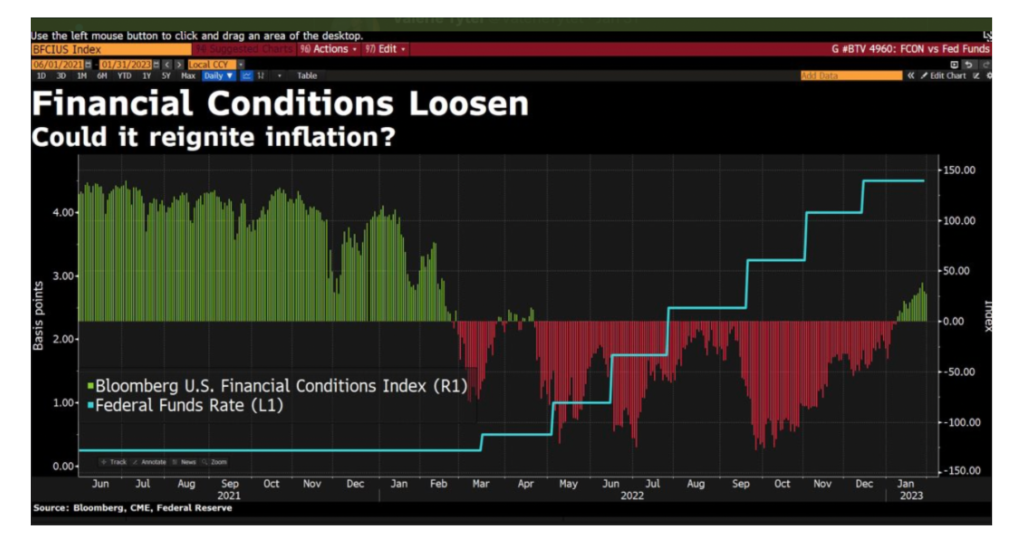

The probable cause of the most recent rally is the state of financial conditions which are signaling economic growth by easing financial conditions.

is could mean a return of inflation and higher Fed Funds rate. Employment is not showing many signs of weakness which is problematic for the Fed. This could mean there is a future rug pull ahead (the Fed being forced to raise rates higher than expected and turn financial conditions back to the red).

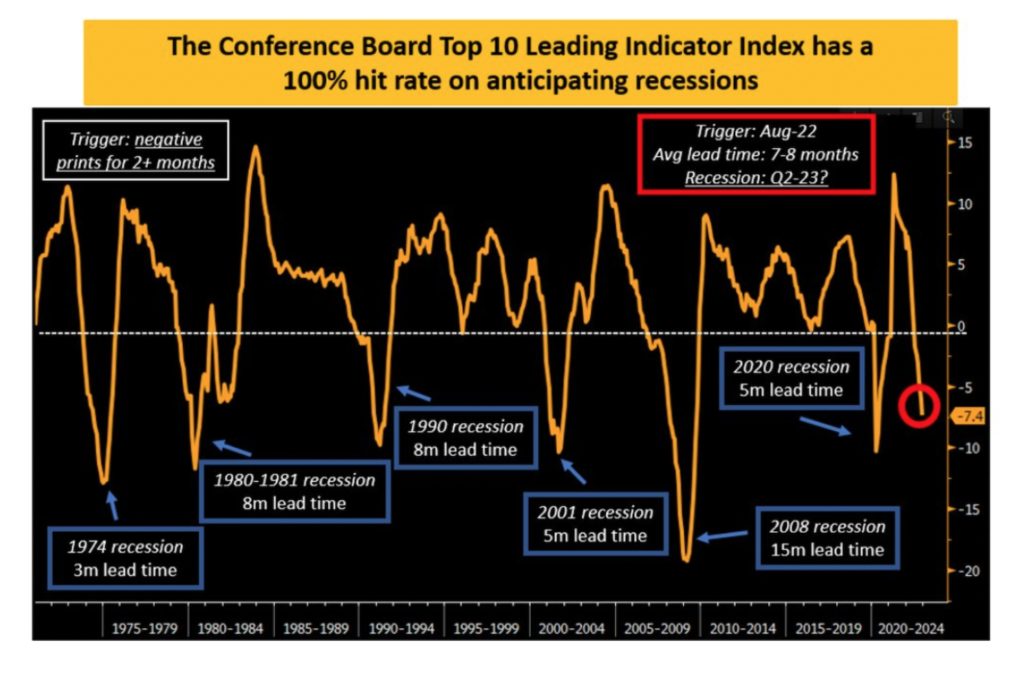

Source: The Conference Board

The Conference Board Leading Economic Indicators has moved into the recession zone.

Summary: Absolute Inflation has probably peaked but there can be more peaks in the cycle (from lower levels). Based on the Conference Board LEI we should be in a full bloom recession by mid 2023.

If the recession is confirmed I could envision another steep decline of 20% to 30%. This would force the Fed to lower the Fed Funds rate and stimulate the economy. It might arguably be the best entry point for stocks in many years.

Any potential entry point until then offers relatively mediocre or poor risk/reward.

So we just wait for the eventual “Fat Pitch”.

Thank you for reading

Brad Pappas

February 6, 2023